What is the definition of a ‘written off car’?

A “written off” car refers to a vehicle that has been severely damaged to the point where it’s either:

a. Unsafe or

b. Uneconomical to repair

There are generally two types of written off cars:

- Economical written-off: When the cost of repairing the vehicle exceeds a certain percentage of the vehicle’s pre-accident value (PAV) (often around 60-75%), it’s considered an economical write-off. Even though the car might be repairable, it doesn’t make financial sense to do so.

- Structural written-off: If the car’s structural integrity has been significantly compromised – for example, the chassis is severely bent or twisted – it’s usually considered a structural write-off. This means it’s unsafe to repair and put back on the road.

In both cases, the car’s insurer will typically declare the vehicle a total loss and compensate the owner based on the vehicle’s pre-accident value (PAV).

After this, the written off vehicle is typically sent to salvage.

Is a ‘total loss’ different to a ‘write-off’?

The terms ‘total loss’ and ‘write-off’ both describe a circumstance where a vehicle has sustained such severe damage that it’s deemed either financially impractical or unsafe to undertake repairs.

However, there can be a subtle difference in meaning depending on the context:

Total Loss: This term is often used by insurance companies when the cost of repairing the vehicle exceeds its pre-accident value (PAV), or a significant percentage of it. When a vehicle is declared a total loss, the at-fault insurance company will typically provide a settlement for the amount that equals to the cars market value prior to the accident, rather than paying for repairs.

However, it’s common for insurance companies to offer less on their settlement than the true market value of a vehicle. This is why we at Auto Claims Assist fight for a fair market-value settlement for our customers when they choose to claim with us.

Write-Off: This term is also used when a vehicle is damaged beyond economical repair, but it can also refer to situations where the vehicle is repairable, but is considered too unsafe to go back on the road. This is usually due to the nature of the damage.

The categories of a written off car

-

In the UK, when a vehicle is declared a total loss or “written off”, it’s categorised by the insurer into one of four write-off categories based on the extent of the damage.

-

Category A (Cat A): The vehicle is so badly damaged that it must be completely scrapped; no parts of it can be reused. The vehicle is deemed a total loss in every sense of the term, and there’s no option for salvage. Cat A vehicles may have been subjected to devastating damage, such as from a serious accident or a fire.

-

Category B (Cat B): This is for vehicles that have sustained severe damage, to the extent that they should never return to the road. However, there might be some parts that can be salvaged and reused in other vehicles. The shell of the vehicle must be destroyed and cannot be resold. This category is generally for vehicles with severe body damage, although some key components may be salvageable.

-

Category S (Cat S, previously Cat C): Previously known as Category C, Cat S is for vehicles that have suffered structural damage, like a bent or twisted chassis, or extensive damage to crumple zones. While it’s possible to repair these vehicles, the cost of doing so is deemed uneconomical by the insurer, usually because it would exceed the vehicle’s value. After repairs, the vehicle must undergo a Vehicle Identity Check by the DVLA before it can be driven again. The Cat S designation will be marked on the vehicle’s history, which could affect its future value.

-

Category N (Cat N, previously Cat D): Previously known as Category D, Cat N is for vehicles that haven’t sustained structural damage, but other issues make repair uneconomical for the insurer. This could include expensive internal damages, electrical faults, or safety-related issues. Unlike Cat S, there’s no requirement for a Vehicle Identity Check by the DVLA before the car is back on the road, but the Cat N designation will remain on the vehicle’s history, which may lower its resale value.

These categories are designed to provide clear information about the severity of the damage a vehicle has sustained. They’re particularly relevant for people considering buying a used car, as any vehicle that’s been written off will have the ‘write-off’ category listed in its history. This can affect the vehicle’s value and insurability.

Why was category C changed to Category S?

In the UK, the category formerly known as Category C was replaced by Category S in October 2017. Category C was used to denote vehicles that had suffered significant damage, typically requiring repairs that exceeded the vehicle’s value. These repairs would have included both structural and non-structural damage.

However, the Association of British Insurers (ABI) revised the write-off categories in 2017 to improve clarity and transparency. As part of this revision, Category C was reclassified as Category S, and the definition of the category was refined. Category S (which stands for “Structural”) now specifically applies to vehicles that have suffered structural damage, such as damage to the chassis or frame.

The change from Category C to Category S was primarily made to emphasise the importance of structural integrity and to provide more accurate information about the nature of the damage sustained by the vehicle. The revised categories aim to assist potential buyers in making informed decisions about the history and condition of vehicles that have been involved in accidents or suffered significant damage.

Why was category D changed to Category N?

In the UK, the category formerly known as Category D was replaced by Category N in October 2017. Category D was used to designate vehicles that had suffered damage that the insurer deemed uneconomical to repair, but the damage was primarily non-structural.

However, the Association of British Insurers (ABI) revised the write-off categories in 2017 to improve clarity and transparency. As part of this revision, Category D was reclassified as Category N, and the definition of the category was refined. Category N (which stands for “Non-Structural”) specifically applies to vehicles that have suffered non-structural damage, such as electrical faults, issues with safety features, or other types of damage that make repairs uneconomical.

The change from Category D to Category N was made to more accurately reflect the nature of the damage sustained by the vehicle and to assist potential buyers in making informed decisions about the history and condition of used cars. It’s important to note that Category N vehicles have not suffered structural damage but were deemed uneconomical to repair by the insurer.

How a car is determined as written-off

The determination begins with a Damage Assessment. Your vehicle will be inspected to estimate the cost of repairs.

Your vehicle’s pre-accident value will then be calculated. This is typically based on factors such as:

- Make

- Model

- Age

- Mileage

- Condition

A variety of resources are used to do this, such as:

- Price guides

- Local sales data

- Online listings for similar vehicles

The estimated repair cost will then be compared to the vehicle’s pre-accident valuation. If the cost of repairs exceeds a certain percentage of the vehicle’s value (the specific percentage can vary), the vehicle may be classified as a write-off. The cutoff percentage is typically somewhere between 50-100% of the vehicle’s value, (usually around 70%). This depends on the organisation that is determining the write-off and their policies.

Finally, based on the findings and comparison, a determination will be made to repair the vehicle or classify it as a write-off.

This write-off assessment should be completed by an engineer that has access to the vehicle. Sometimes, insurance companies have been known to provide a write-off determination over the phone without accessing the vehicle.

In order for your vehicle to have an independent, thorough assessment, non-fault drivers should contact an accident management company, such as Auto Claims Assist. We have a network of BSI Kitemark accredited accident repair garages and engineers who provided a detailed and accurate write-off determination, at no cost to the non-fault driver.

To start your vehicle’s write-off determination, get in touch with us today on 0330 128 1407 or Start your claim now >

Is the number of written off cars increasing or decreasing in the UK?:

Road traffic accidents are the most common reasons why cars are written off.

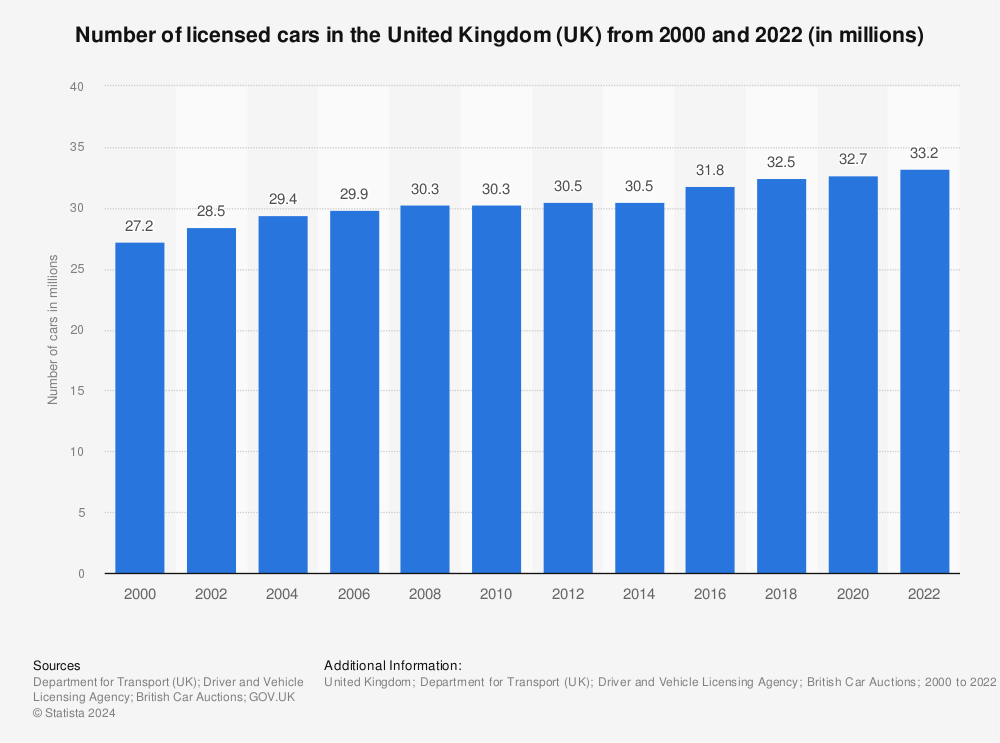

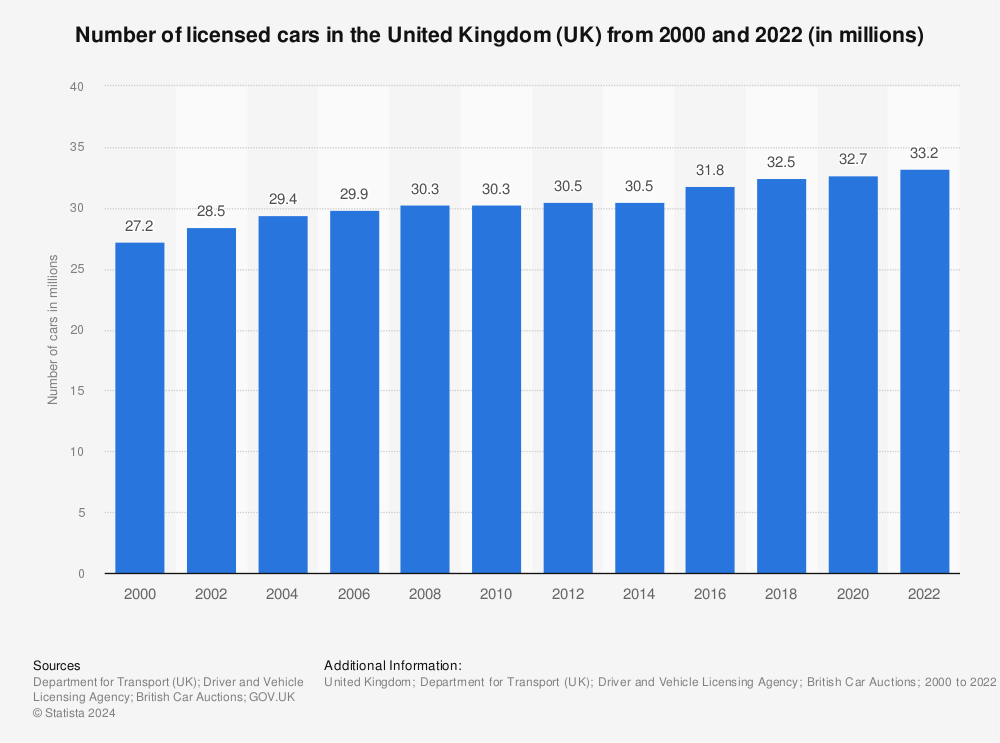

Data shows that the number of licensed cars over the the two decades spanning 2000 – 2020 had an consistent increase in registered UK vehicles.

Source: Statista

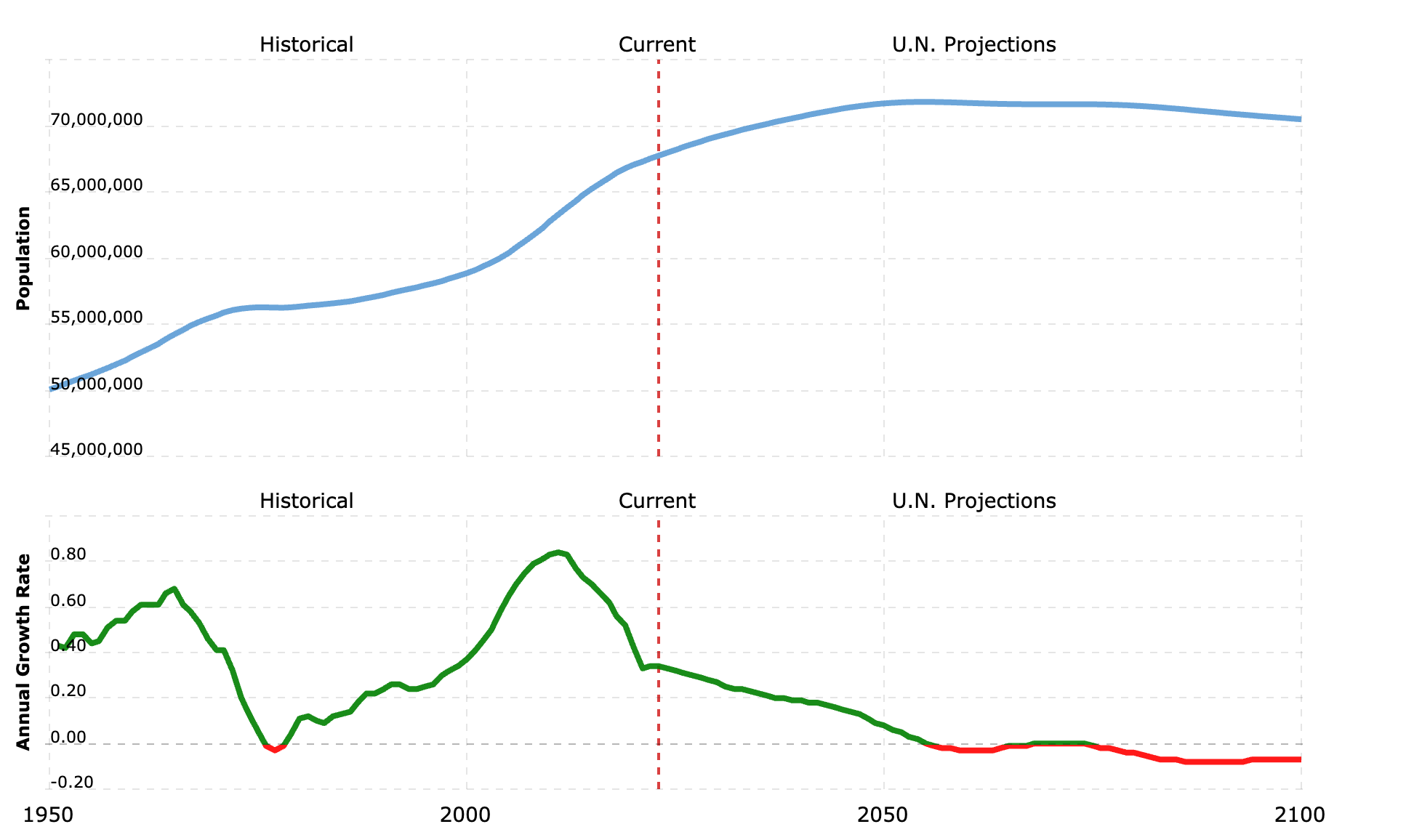

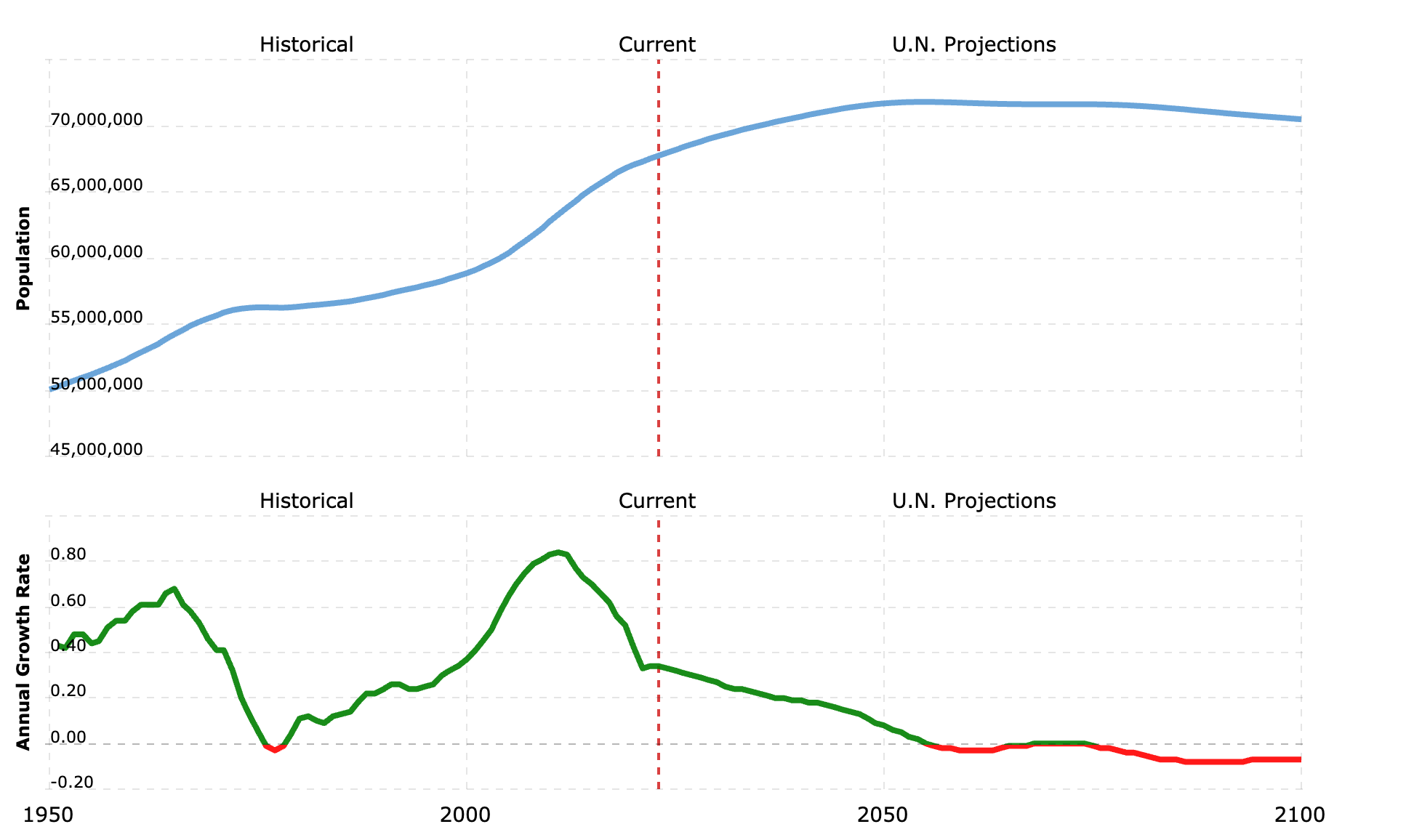

The increase in registered vehicles in the UK matches the increase in UK population. This increase in population shows a potential link between this and more people being on the roads. This increase is estimated to continue through past the year 2050:

Source: Macrotrends

Source: Macrotrends

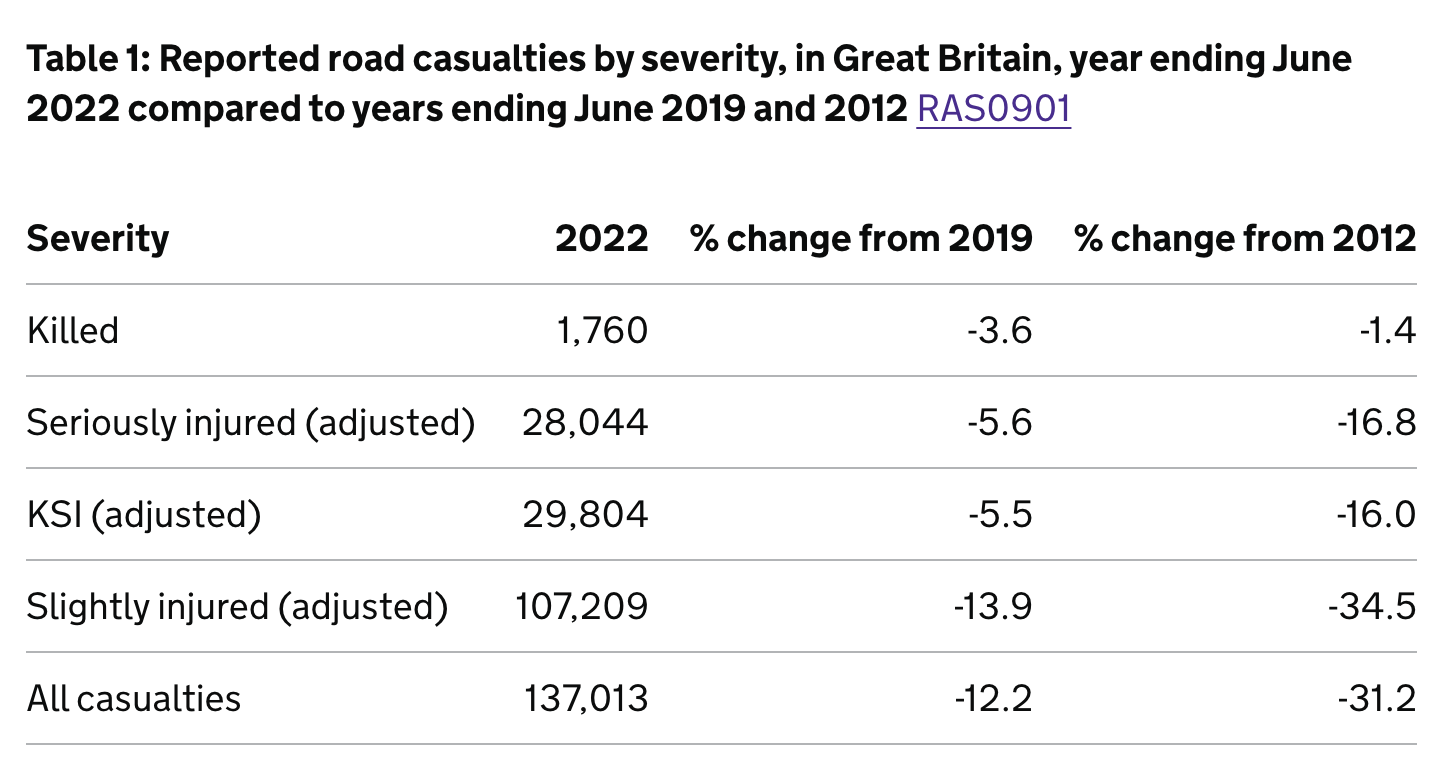

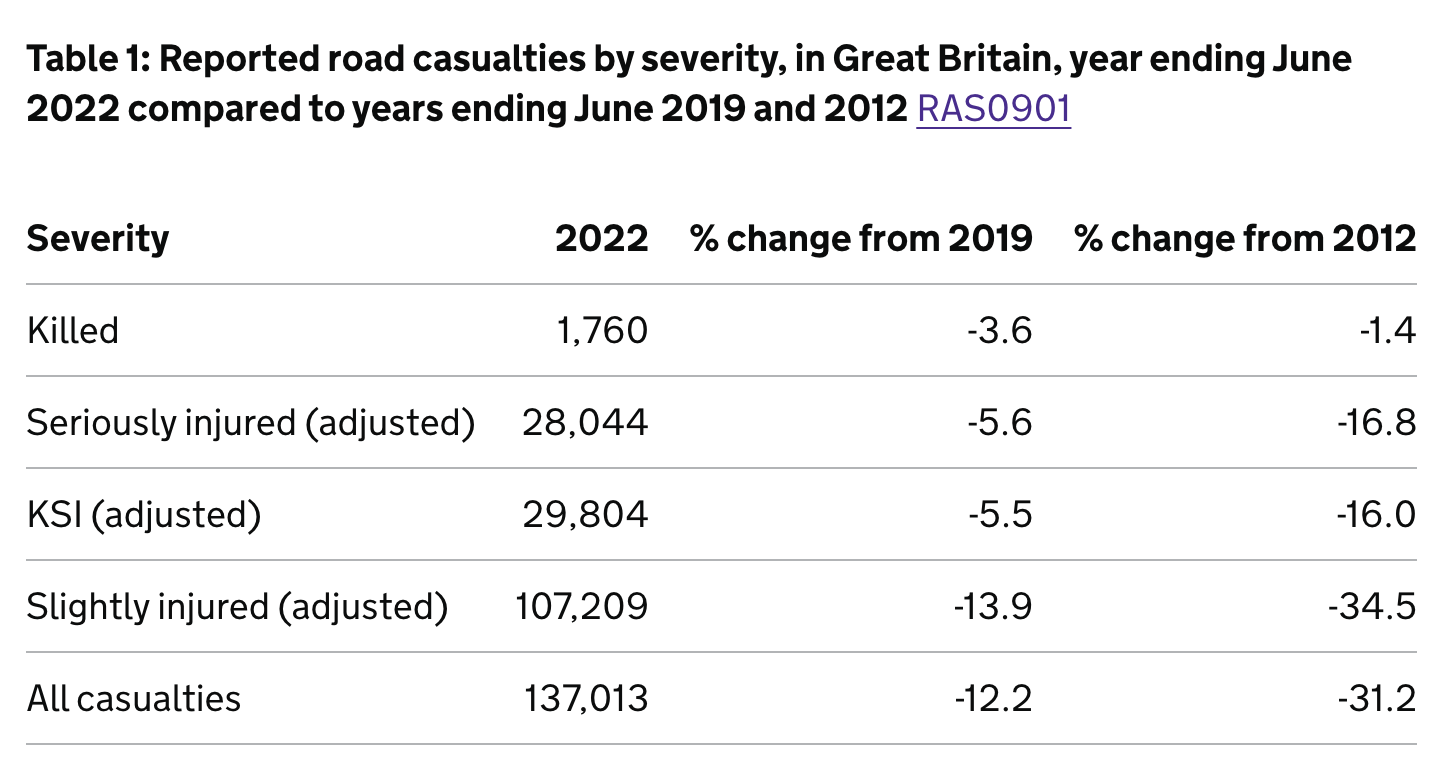

However, given the clear increase in UK population and registered road users, the number of reported road casualties in Great Britain is not increasing. Instead, the total number of causalities has been declining, with a consistent decline spanning back over two decades between 2012 – 2022:

Source: Gov UK

Source: Gov UK

While there are no public records for the official number of written off vehicles in the UK, this data suggests that road traffic accidents are potentially decreasing, or at the very minimum, the seriousness of accidents are reducing. This might suggest that the ratio of written-off vehicles is also decreasing with it.

On the contrary, however, newer vehicles with more complex technology is leading to a rise in repair costs. This is down to the technology being used and the labour required to fix certain types of technology.

One example of this is a report by Reuters, which describes how for many electric vehicles, there is no way to repair or assess even slightly damaged battery packs after accidents, forcing insurance companies to write-off cars with few miles – leading to higher premiums and undercutting gains from going electric.

We can see that technology helps to reduce car accidents. This is visible in the road traffic accidents data from the UK Government. However, the same technologies are also causing vehicles to be written-off earlier than they might have otherwise been due to them not being economically viable to repair.

As a conclusion, we may see this result in the number of written off cars overall increasing rather than decreasing.