Choosing the right Credit Hire service after a non-fault accident

If you've been in a non-fault accident, you're entitled to a replacement vehicle at no cost to you. Our credit hire solutions ensure you remain mobile with a suitable hire vehicle while we manage your claim, importantly, without impacting your insurance policy. Auto Claims Assist offers specialist support for non-fault drivers, providing services designed to protect your rights and reduce disruption to your routine.

What is Credit Hire?

Credit hire provides a replacement vehicle to drivers who weren't at fault in an accident, with the costs typically recovered from the at-fault driver's insurer. Unlike standard car rental, this service ensures you receive a vehicle comparable to your own in size and specification. This allows you to carry on as normal while your car is repaired or replaced, without any negative effect on your own insurance policy.

What is a Credit Hire company?

A specialist organisation offering credit hire provides these vehicle replacement services to non-fault drivers. Often, these providers also operate as accident management companies, meaning they don't just supply the replacement vehicle but can also manage the entire claim process.

This comprehensive role allows them to handle all post-accident elements, including insurer communications, repair coordination, and support with legal or administrative tasks. Choosing a provider like Auto Claims Assist ensures dedicated service, expert claim management, and a commitment to minimising your inconvenience and stress.

The history and evolution of Credit Hire

The concept of credit hire emerged in the 1980s to help non-fault drivers regain mobility quickly post-accident. While initially a simple temporary transport solution, it has evolved to offer greater protection for non-fault drivers' rights and reduce financial impact.

Now, it's an established part of the insurance sector, upheld by bodies like The Credit Hire Organisation (CHO) and guided by protocols such as The General Terms of Agreement (GTA). These frameworks promote fairness and industry standards, providing an equitable solution for drivers who shouldn't bear the expense or fallout from another's error.

Key benefits of using a dedicated Credit Hire service

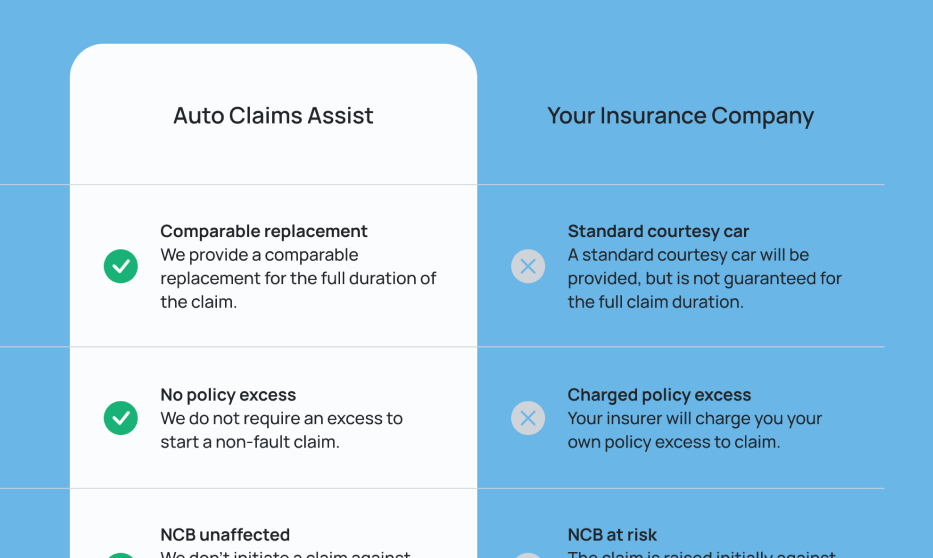

After an accident, many instinctively contact their own insurer. However, for a non-fault incident, this might not be the most advantageous route. Insurers primarily focus on policies they issue and claims against them, rather than managing non-fault claims involving a different (at-fault) party insurer.

Choosing a specialist service like Auto Claims Assist offers several advantages:

-

Protected no-claims bonus: Your bonus remains safe as we claim from the at-fault party's insurance, not yours.

-

No excess to pay: Unlike claiming through your insurer, there’s no excess fee, saving you from unexpected out-of-pocket expenses.

-

Like-for-Like Replacement Vehicle: Receive a vehicle matching your own's size and spec while yours is unavailable.

-

Avoiding premium increases: We help you avoid the risk of having a pending claim on your policy or losing your no-claims bonus, both of which could lead to higher premiums.

-

Expert support throughout: Our dedicated team handles everything, providing guidance and keeping you informed every step of the way.

Why NOT to claim through your insurer

-

Pending claims and premium increases: Claiming through your insurer may result in a pending claim on your policy, potentially increasing your premiums.

-

Loss of no-claims bonus: Even when not at fault, your insurer may reduce or remove your no-claims bonus until liability is confirmed.

-

Excess fees: You'll likely need to pay your policy excess upfront, which can be a significant outlay.

-

Limited replacement vehicle options: Insurers often provide a standard courtesy car that may not match your vehicle’s size or specifications.

-

Costly Referrals: Your insurer might still refer you to an accident management service, sometimes for a fee they receive.

Choosing Auto Claims Assist means your claim is handled by specialists in non-fault accidents, safeguarding your rights and helping you avoid these common pitfalls. You get the right support from day one, with a team focused entirely on managing your non-fault claim effectively.

Auto Claims Assist – Your Complete Solution

Auto Claims Assist provides both accident management and credit hire services – a complete solution under one roof. We manage every aspect of your claim, from vehicle recovery and repairs to supplying a replacement vehicle and handling all insurer communications. This integrated approach means no juggling multiple providers, saving you time, stress, and money.

We offer the best of both worlds

-

The dedicated support of a credit hire specialist

-

The full-service benefits of accident management

How to Make a Credit Hire Claim with Auto Claims Assist

For more information, explore the credit hire process in detail here.

Gathering evidence for your claim

To support your claim, gathering information such as the other driver’s details (including their insurance information, if possible, to assist with claims against the party insurer), witness statements, photos of the accident scene, and a police report(if made) is beneficial. We can help you compile and present this evidence for a smoother process

See our guide for what to do after a car accident for more information on evidence gathering.

Common Questions

About Credit Hire View Resources

Using a credit hire company, like Auto Claims Assist, helps avoid the risk of increased premiums due to a pending claim or loss of no-claims bonus. However, it’s important to note that some insurers may still consider a non-fault accident when calculating future premiums.

Credit hire provides a replacement vehicle after an accident, while accident management covers the full range of services, including vehicle recovery, repairs, and claims management. Auto Claims Assist is both an accident management company and credit hire company, offering both credit hire and accident management. This gives you a complete solution, all under one roof.

No, with Auto Claims Assist, there are no no upfront costs. We aim to recover all legitimate expenses, including hire charges for the replacement vehicle, directly from the at-fault driver’s insurer. You won't pay for our service.

If you’ve had a non-fault accident, get started with us today

Choosing Auto Claims Assist means opting for a service dedicated to protecting your rights and ensuring your recovery is as smooth as possible. Our expertise, client care commitment, and comprehensive services are here to support you throughout the process.

Choosing Auto Claims Assist,

Your Trusted Claims Management Company

“Excellent assistance at the roadside. Very kind, caring and knowledgable. If I ever had an accident again, Auto Claims Assist would be my first call.”

15+

Years of expertise

1,000+

36,000+

Successful cases

After non-fault accidents

What our customers say

Don’t just take our word for it. Our customers rate us ‘EXCELLENT’ on Trustpilot. See what they have to say about their experiences with Auto Claims Assist after a non-fault accident:

Request a call back

Our team of non-fault claim specialists are ready to answer any questions you have. Provide your details here to request a callback. One of our advisors will call you back as soon as possible. Alternatively, call us on 0330 128 1407 to speak to someone now.

One of our team will give you a call