What insurance details do I give in an accident

Under Section 170 of the Road Traffic Act , a driver must provide their insurance details if the accident results in:

- Injury to any person (other than the driver who caused the accident).

- Damage to another vehicle or its trailer.

- Harm to specific animals, such as dogs or horses.

If you’re asked for your insurance details in these circumstances, or if you need to request them from another driver, the following information should be shared:

- The name of the insurance company (insurer).

- The insurance policy number, if available.

It’s important to collect not just insurance information, but also the other driver’s details, vehicle information, and key accident details while you’re still at the scene. For more on this, see:

What details to exchange in a car accident →Where to look for your car insurance details

Forgotten which provider your car insurance is with?

It’s more common than you might think to forget who your car insurance is with.

With so many comparison websites available and the habit of switching providers each year to save money, remembering your current insurer can often slip down the priority list, especially with everything else life throws at you.

If you’ve forgotten the name of your car insurance provider or policy number, don’t worry - there are a few ways to find this information:

Look for terms like ‘car insurance’ or ‘insurance policy.’ Emails from your provider often include your certificate of motor insurance and your policy number.

Review your bank statements for payments made to your insurance company. This can help identify your provider.

If you don’t need the information immediately, you can request it from the Motor Insurers' Bureau (MIB) by completing their Data Subject Access Request form. You’ll need to provide a valid ID (e.g. driving licence or passport) and proof of address (e.g. utility bill or HMRC letter). Once completed, you can submit the completed form:

-

By Post

Service Support Team

MIB

Linford Wood House

6 - 12 Capital Drive

Milton Keynes

MK14 6XT

-

By Email

DSAR@mib.org.uk

How to retrieve required insurance details

If you know your insurance provider but don’t have your policy number, you can contact them directly to retrieve it.

When reaching out to your insurer after a non-fault accident, be clear that you’re only requesting your policy number and are not initiating a claim. Starting a claim with your own insurer could trigger a claim against your own policy, which may leave you worse off.

As a non-fault driver, you have the option to work with an accident management company like Auto Claims Assist. We handle the entire claims process on your behalf, including:

- Accident roadside recovery

- Arranging a comparable replacement vehicle

- Managing vehicle accident repairs

All of this is covered by the at-fault driver’s insurance, meaning there’s no cost to you.

If you’re unsure who your insurer is, don’t worry - contact Auto Claims Assist first. We can help you locate these insurance details while ensuring you don’t accidentally start a claim with your own insurer against your own policy.

For more details, read our guide on the benefits of claiming with an accident management company versus your own insurer.

Accident Management Company vs Insurance Company→Need to check if a car is insured?

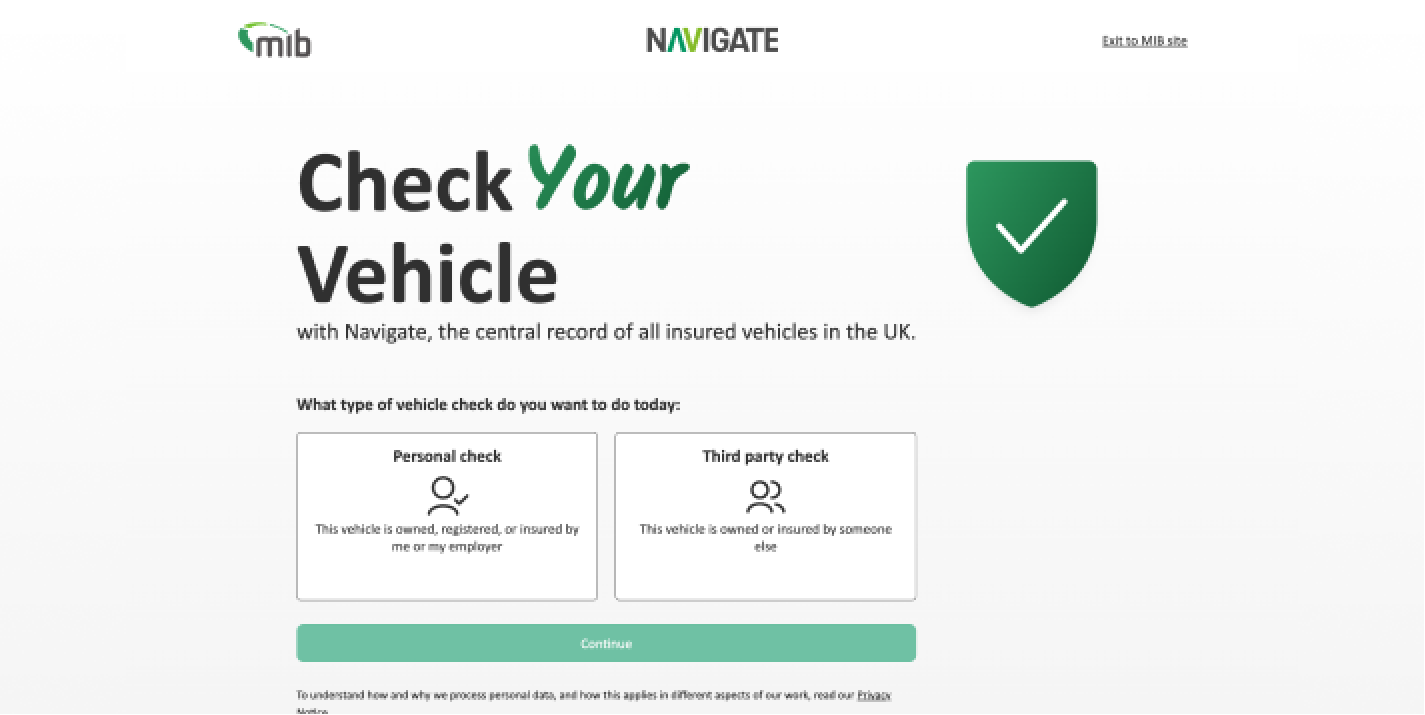

There are official tools that let you check insurance status quickly. While they won’t show full policy details, they’re useful if you’re unsure about the status of a car, whether it’s yours or another driver’s after an accident.

Head to our How to check if a car is insured page for all the information you need.

What to do if the other driver is uninsured

Discovering that the other driver involved in an accident is uninsured can be frustrating and concerning. However, it’s important to stay calm and understand what to do next.

If you find yourself in this situation, you may still be able to recover your losses through the Motor Insurers’ Bureau (MIB). The MIB handles claims for accidents caused by uninsured or untraced drivers. This can help innocent parties receive compensation for damages and injuries.

What type of insurance do you legally need to drive?

In the UK, it is against the law to drive a vehicle on public roads or in public spaces without at least third-party insurance. This minimum level of cover doesn’t protect your own vehicle but ensures that other people and their property are covered if you’re involved in an accident.

In addition to the minimum requirement, there are two other main types of motor insurance policies for broader protection:

-

Third-party, fire, and theft

This policy includes the protection offered by third-party insurance but also covers damage or loss to your own vehicle caused by fire or theft.

-

Comprehensive cover

This is the most extensive type of cover, offering all the benefits of third-party, fire, and theft policies, along with cover for repairs to your own vehicle in case of an accident.

It’s also essential to remember that insurance applies to both the vehicle and the driver. For example, even if the car you’re driving is insured - such as a friend’s vehicle - you must ensure your own insurance policy permits you to drive it legally.

Penalties for driving without insurance

Driving without insurance carries serious consequences. If caught, the police may issue:

In some cases, you could even face a court prosecution, resulting in an unlimited fine or disqualification from driving.

Ensuring you have the right insurance is not just a legal requirement - it’s a safeguard for you, your vehicle, and others on the road.

Getting the support you deserve after a non-fault accident

At Auto Claims Assist, we specialise in supporting non-fault drivers.

Our accident management services take care of every aspect of your non-fault accident claim, with no cost to you.

Why choose Auto Claims Assist?

Unlike insurance companies, our sole focus is on protecting your rights and ensuring the best outcome for you as a non-fault driver. We manage the entire process on your behalf, including:

- Vehicle recovery

- Communication with third-party insurers

- Arranging a comparable replacement vehicle

- Managing high-quality vehicle repairs

All of this is handled without directly affecting your insurance policy or no-claims bonus.

For a detailed overview of our services and how we can help, visit our page:

Third party insurance explained→Whether you’re ready to make a claim or simply need advice, our team of experts are here to assist you.

Auto Claims Assist

Advice and support when you need it most.

Related Articles

Request a callback