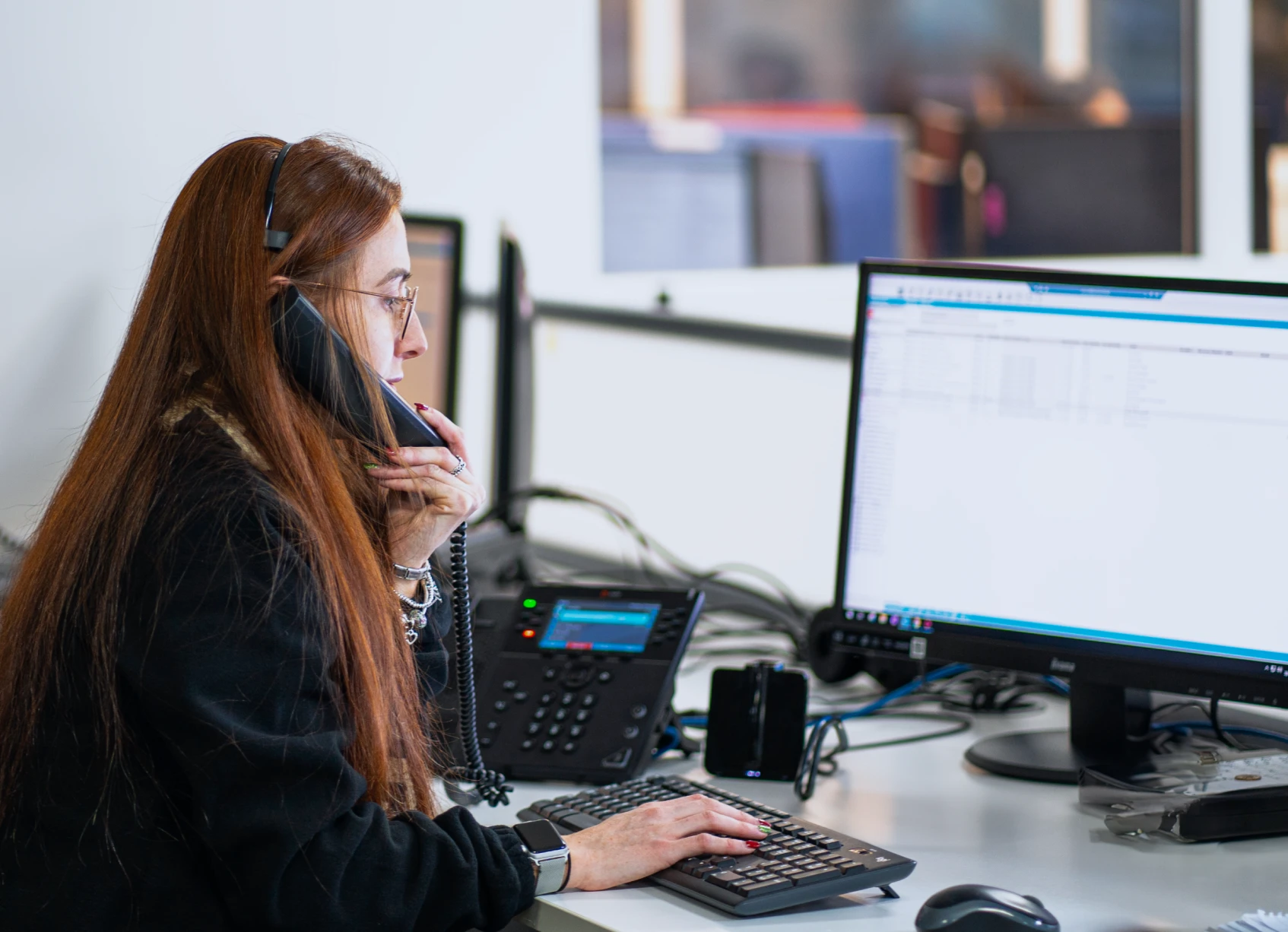

Need to claim on someone's insurance?

We can handle it all for you

After a non-fault accident, claiming on someone else’s insurance is straightforward with Auto Claims Assist. Learn how we simplify the process and handle everything for you, ensuring a stress-free experience from start to finish.

Speak to a specialist claims advisor:

Trusted by thousands of people every year

How to Make a Claim: An Overview of Your 3 Options

After a non-fault accident, you have three main paths you can take to make a claim. See how using Auto Claims Assist compares to the other routes available.

Claim via Your Insurer

You will usually have to pay your policy excess upfront and your no-claims bonus can be temporarily affected until liability is established and costs are claimed back.

Recommended

Use Auto Claims Assist

We claim directly from their insurer, so there is no excess to pay and your No-Claims Bonus is protected.

We manage the entire process for you, providing a comparable replacement vehicle while your car is off the road.

Claim via Their Insurer

This involves handling all the difficult negotiations yourself – from arranging for approved repairs to securing a suitable hire car with a company that isn't on your side.

Understanding your options to claim

The path you choose to make your claim can have a significant impact on the outcome. See how the options compare in our table below.

| Benefits | Your insurer | Auto Claims Assist | Third Party Insurer |

|---|---|---|---|

| Fight for your liability | |||

| Dedicated claims handler | |||

| Comparable replacement vehicle | |||

| Manufacturer approved parts | |||

| Fair write-off valuation | |||

| No excess to pay | |||

| Unaffected no claims bonus |

Speak to a specialist claims advisor

Our end-to-end service

We handle every detail of your non-fault claim from the scene of the accident to getting you back on the road. Here is how our comprehensive service works for you:

Roadside recovery if needed

If your vehicle isn't drivable, our first priority is your safety. We’ll recover you and your vehicle from the roadside. We will also arrange for the secure storage of your vehicle while the claim is processed.

Read more

Complete claims management

From your first call, we assign you a dedicated claims handler. Our team of non-fault specialists then manages your claim from start-to-finish, handling all communications and negotiations.

Read more

Comparable replacement vehicle

You will not be left without suitable transport. We provide you with a comparable replacement vehicle—similar in size and spec to your own—and you can use it for the full duration your car is off the road.

Read more

BSI accredited repair / total loss settlement

Our trusted, BSI accredited repair network will repair your vehicle to the highest standards, using manufacturer-approved parts and paints. If your vehicle is written off, we will work to ensure you receive a fair settlement figure.

Read more

Personal injury support

If you or your passengers have been injured in the accident, our partnered personal injury solicitors can provide expert assistance to help you claim the compensation you are entitled to.

Read more

All costs are covered by the at-fault driver's insurer

There is no cost to you for any part of our service. We claim all costs for the recovery, storage, replacement vehicle, and repairs directly from the third-party insurer.

Request a callback