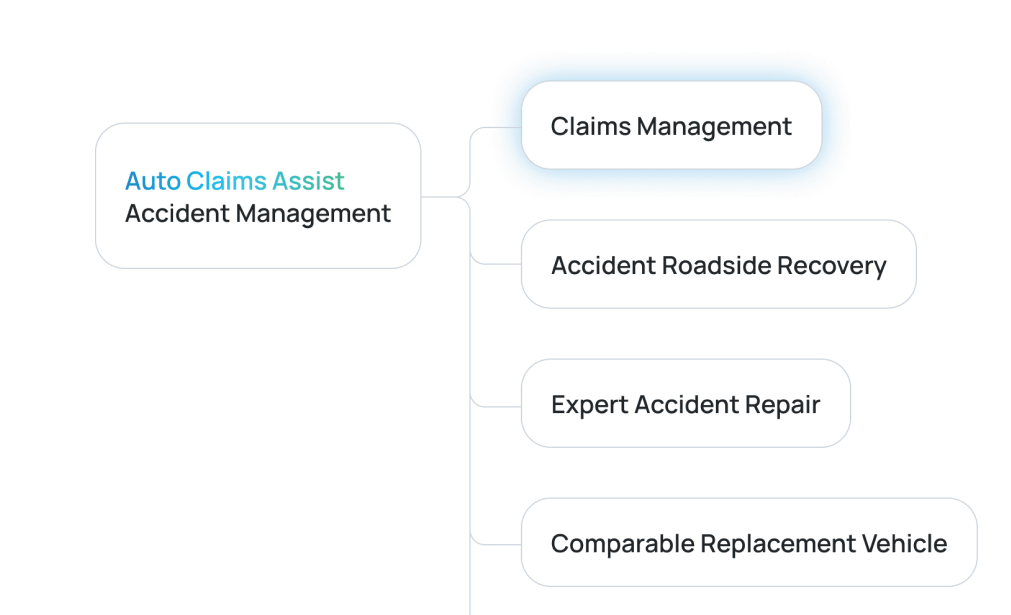

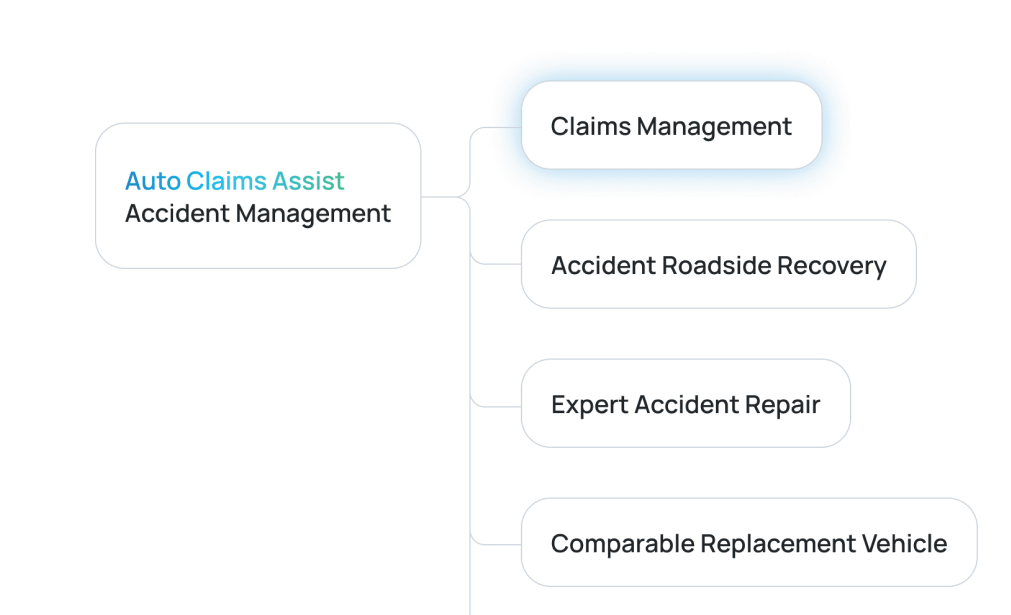

Included as part of our Accident Management Services, at no cost to you.

If you’ve had a non-fault accident, the last thing you need is the added stress of starting and managing a non-fault claim.

With our claims management service, we handle everything for you... all at no cost to you.

Call us on

0330 128 1407

After an accident that wasn't your fault, navigating the claims process while also protecting your best interests can be unfamiliar territory. Luckily, you’ve got our accident experts by your side, every step of the way.

Our claims management service removes the stress, inconvenience and complexity of a road traffic accident. We do this by handling your non-fault claim for you, from start to finish. Better still, because the accident wasn’t your fault, there’s no cost to you for the service.

We take care of it all, so you can focus on getting back to normal.

Got questions?

Call us on 0330 128 1407 to speak to us now. →

Ready to get started?

Start your claim online here →

A car accident can drastically impact your life. It’s important that the aftermath is managed carefully and correctly. Otherwise, consequences can be negative.

With Auto Claims Assist, you aren’t just another number. We’re committed to delivering an exceptional customer experience. So, at the start of your claim, we assign you with a dedicated claims handler.

Your handler will be your primary point of contact and will:

You’re in the hands of a capable, knowledgeable, experienced non-fault claims expert.

Your dedicated claims handler personally manages your claim throughout the non-fault claim process.

As the non-fault driver, you have entitlements.

When we manage your non-fault claim, you receive everything you’re entitled to without any financial burden or out-of-pocket expenses.

As the accident wasn’t your fault, our accident claims management comes at no cost to you.

Why is there no cost?

Why is there no cost?

All costs are covered by the at-fault driver’s insurer

As part of our service, we claim all costs back from the at-fault drivers insurance company. These costs include:

You don’t pay an insurer excess

Unlike if you were to contact your own insurance company and claim with them, with us there’s no policy excess to pay. This is because we don’t claim against your own insurance policy. Instead, we claim directly against the at-fault driver’s insurance policy; leaving your own policy unaffected.

Claims Management is included as part of our Accident Management Services

After a non-fault accident, we manage everything for you from start-to-finish. See what’s included in our Accident Management Service.

Explore services included

Auto Claims Assist makes claiming simple, efficient, and hassle-free

Full non-fault claim process01

Speak to us first after an accident that wasn't your fault.

Call us on 0330 128 140702

We gather all of the incident details from you and assess your eligibility for our Accident Management Services - Our services are only available to non-fault drivers.

03

Your dedicated claims handler dispatches a replacement hire vehicle that is comparable to your own.

04

We arrange for your vehicle to be repaired at one of our nationwide, BSI Kitemark Accredited accident repair centres. Or, If your vehicle is written off, we ensure you receive a fair pre-accident valuation.

05

While managing your entire claim, we negotiate with and recover all costs from the at-fault driver’s insurance company on your behalf. This ensures there’s nothing for you to pay.

06

With you car repaired or your total loss settlement paid to you, we get you back on the road and back to normality. Afterwards, we’re always here if you ever have any questions or concerns.

We’re here to minimise the impact a non-fault accident has on your life. If the accident wasn’t your fault, it’s not fair that you’re inconvenienced as a result. When you choose Auto Claims Assist to manage your non-fault claim, you’re choosing:

An experienced team with expertise that understands the intricacies of non-fault claims.

From recovering your vehicle at the roadside to recovering all of the costs; we handle the details, so you don’t have to.

Never worry about being passed from pillar to post. You’ll have a direct line of communication to a claims handler thats dedicated to your case.

An independent expert, on your side to prove you were not at fault in the accident, protecting your interests.

Knowing your non-fault claim is being fully handled by experts with the utmost care, respect and attention.

There’s no cost to you for the privilege of claims management and all of the accident management services that come with it.

‘Claims management’ is a start-to-finish management service that is used by a person who has been in an incident/accident that wasn’t their fault and who needs to make a non-fault insurance claim.

The non-fault claim is processed directly against the at-fault party’s insurance company. It is processed by a Claims Management Company on behalf of the non-fault party.

In the UK, people who have been involved in an accident and weren’t at fault can use a Claims Management Service.

After an incident, a person who wasn’t at fault has a right to minimise their losses and to be compensated for harm or loss suffered, due to someone else's negligence. Using a claims management service is included in these non-fault rights, along with other Accident Management Services.

If you’ve been in an accident that wasn’t your fault, contact Auto Claims Assist - Your Trusted Accident and Claims Management Company. Our specialist team manage everything for you, from start-to-finish. All at no cost to you. Call 0330 128 1407 or start your claim online now

Claims management is a service provided by a Claims Management Company. In the case of a road traffic accident, these companies are also known as Accident Management Companies.

An Accident Management Company is a claims management company that specialise specifically in claims management after a non-fault road traffic accident.

Here at Auto Claims Assist, we are a specialist Claims Management Company that provide Claims Management as part of our Accident Management Services after a non-fault road traffic accident. We manage everything for you after an accident, at no cost to you.

Our Accident Management Services also include Credit Hire and Credit Repair. These additional services are specific to Non-Fault Road Traffic Accident Claims.

A Claims Management Company is a company that manages a person’s non-fault insurance claim on their behalf after they’ve been in an accident that wasn’t their fault. They handle the entire claim, from start to finish. Additionally, there’s no cost the person who is using their service. This is because the Claims Management Company claims all of the costs back from the at-fault party’s insurance company.

Auto Claims Assist is a Claims Management Company that specialises in Non-Fault Road Traffic Accidents; Also known as an Accident Management Company.

When making your non-fault claim with Auto Claims Assist, there is no cost to you for claims management. This is because all of the costs associated with your non-fault claim are claimed back from the at-fault driver’s insurance company.

The recovery of all costs is also included within the claims management process. So, not only do we fight to ensure that all claim costs are agreed to be by the at-fault driver’s insurer, but we also ensure that the payments are made by the insurer on your behalf.

Every aspect of managing a non-fault claim is included within claims management. This is from initially drafting your case and preparing evidence, to negotiating the final settlement and payment recovery with the insurer.

With Auto Claims Assist, you’ll be assigned a dedicated claim handler who will handle everything for you. This includes:

Choosing Auto Claims Assist,

Your Trusted Claims Management Company

“Exceptional service throughout my claim. The communication from my case handler was superb. I would highly recommend Auto Claims Assist.”

15+

Years of expertise

1,000+

36,000+

Successful cases

Our team are ready to discuss the details of your accident and start your non-fault claim.

To get started with Auto Claims Assist, simply call to us on 0330 128 1407 or start your claim online here

To promote trust, transparency and uphold industry standards, we follow the standards set by both the Credit Hire Organisation (CHO) and the General Terms of Agreement (GTA) for credit hire services.

We are:

Independent to insurers

On your side

Dedicated to delivering an award-winning, exceptional customer experience.

You can feel confident knowing that your claim is being handled professionally by experts.

We’re a UK leading Accident Management Company founded in 2009, helping thousands of people, throughout the country, every year after non-fault accidents. Our team of accident experts have over 15+ years of experience in the complexities of Accident Management and Credit Hire.

Don’t just take our word for it. Our customers rate us ‘EXCELLENT’ on Trustpilot. See what they have to say about their experiences with Auto Claims Assist after a non-fault accident:

Our team of non-fault claim specialists are ready to answer any questions you have. Provide your details here to request a callback. One of our advisors will call you back as soon as possible. Alternatively, call us on 0330 128 1407 to speak to someone now.

One of our team will give you a call