How to check if a car is insured in the UK

Written by Tyler Lally

Reviewed by Ian Budsworth

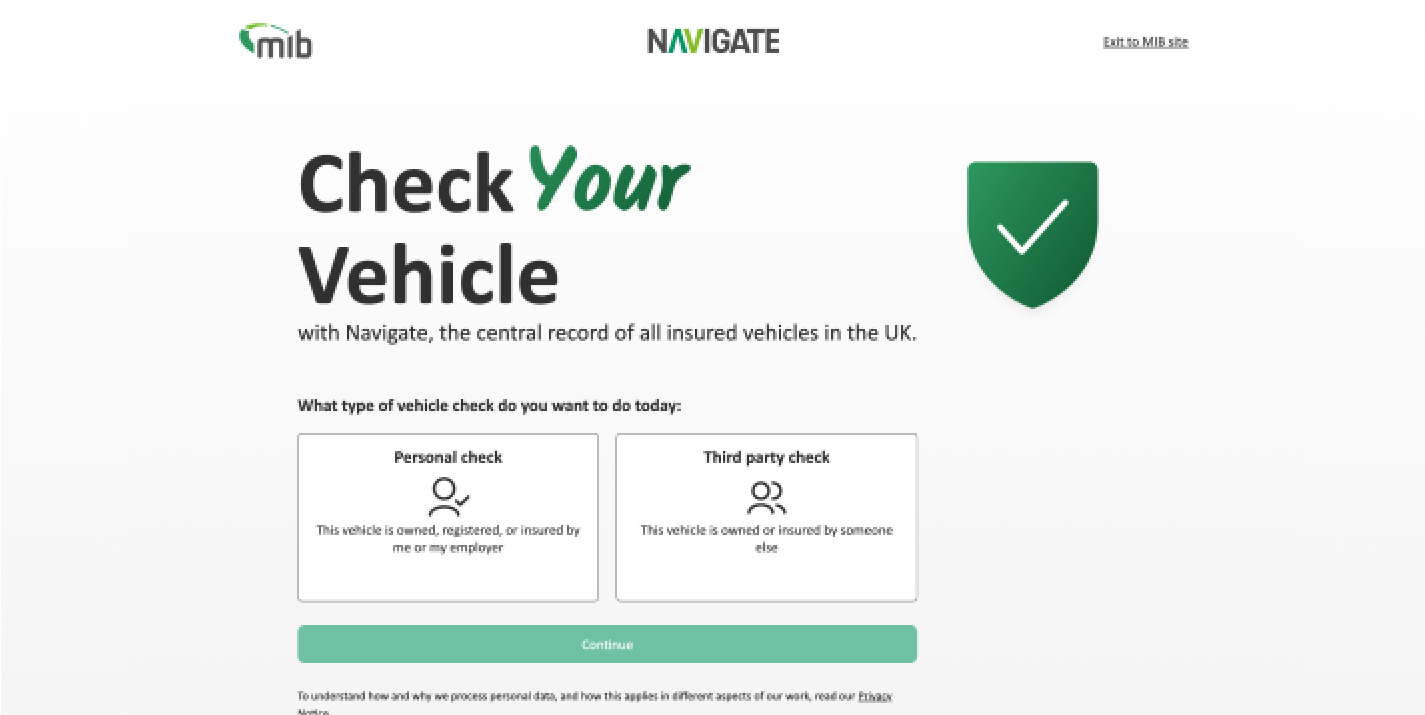

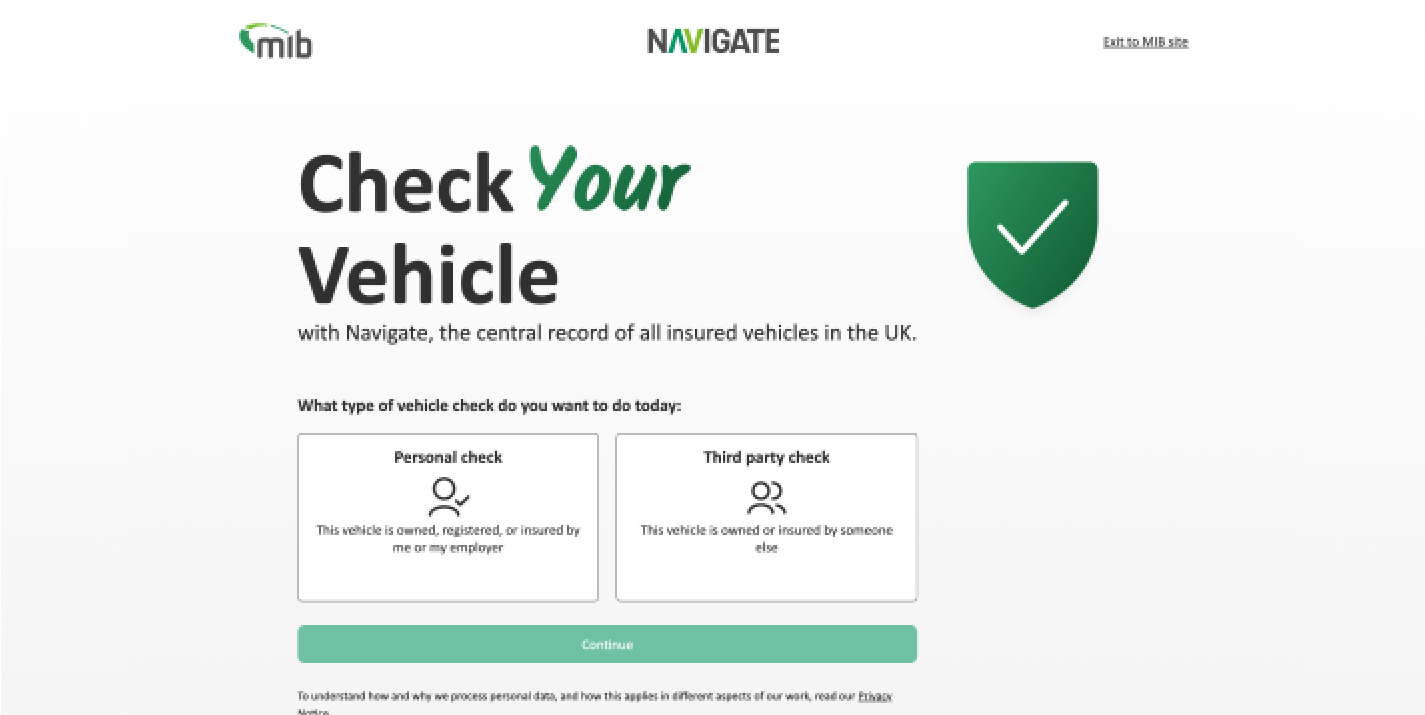

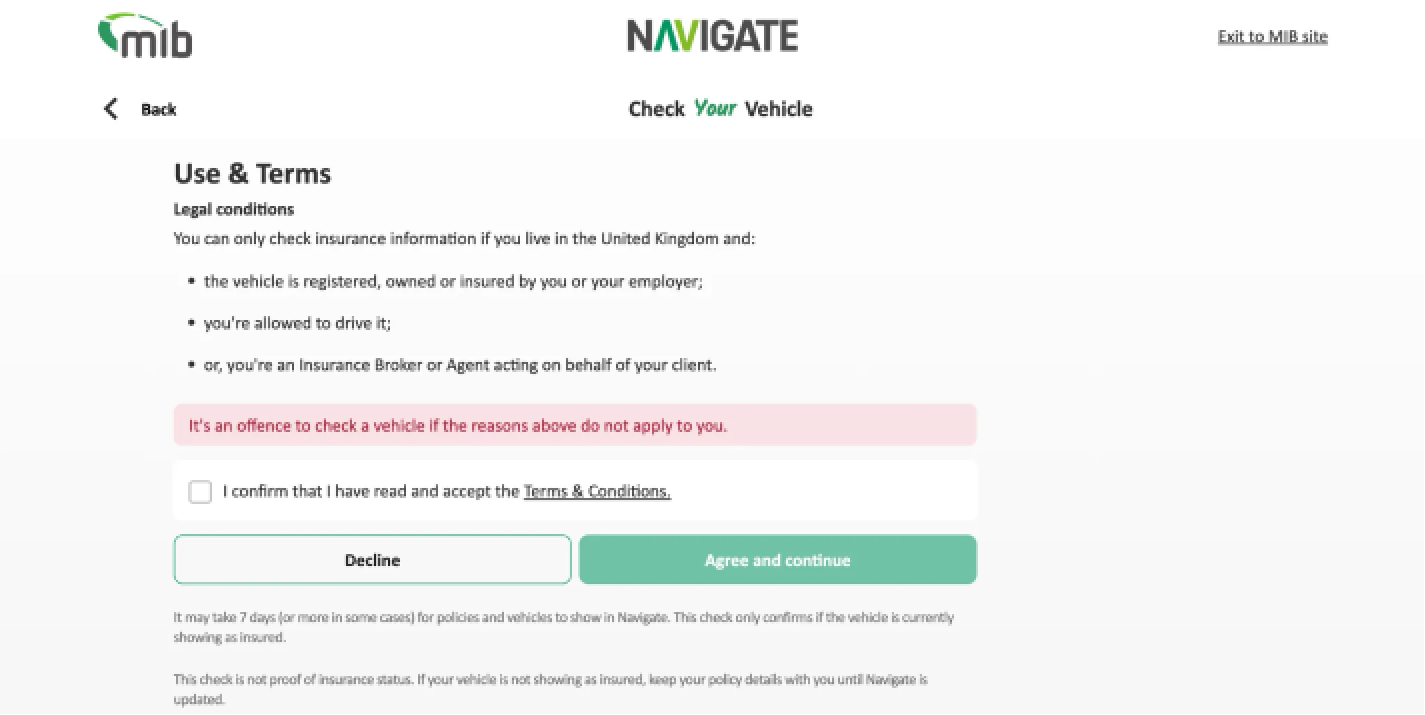

The official way to check car insurance

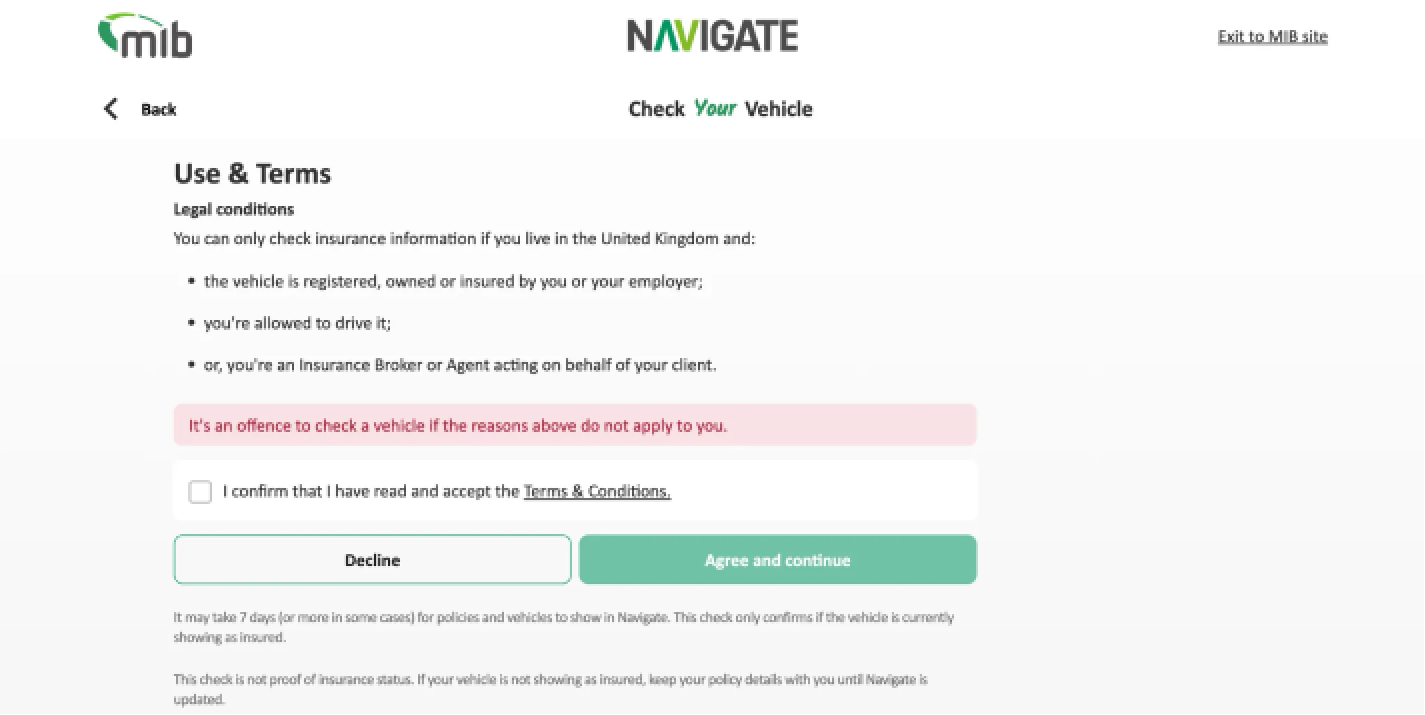

How to check your own vehicle's insurance status

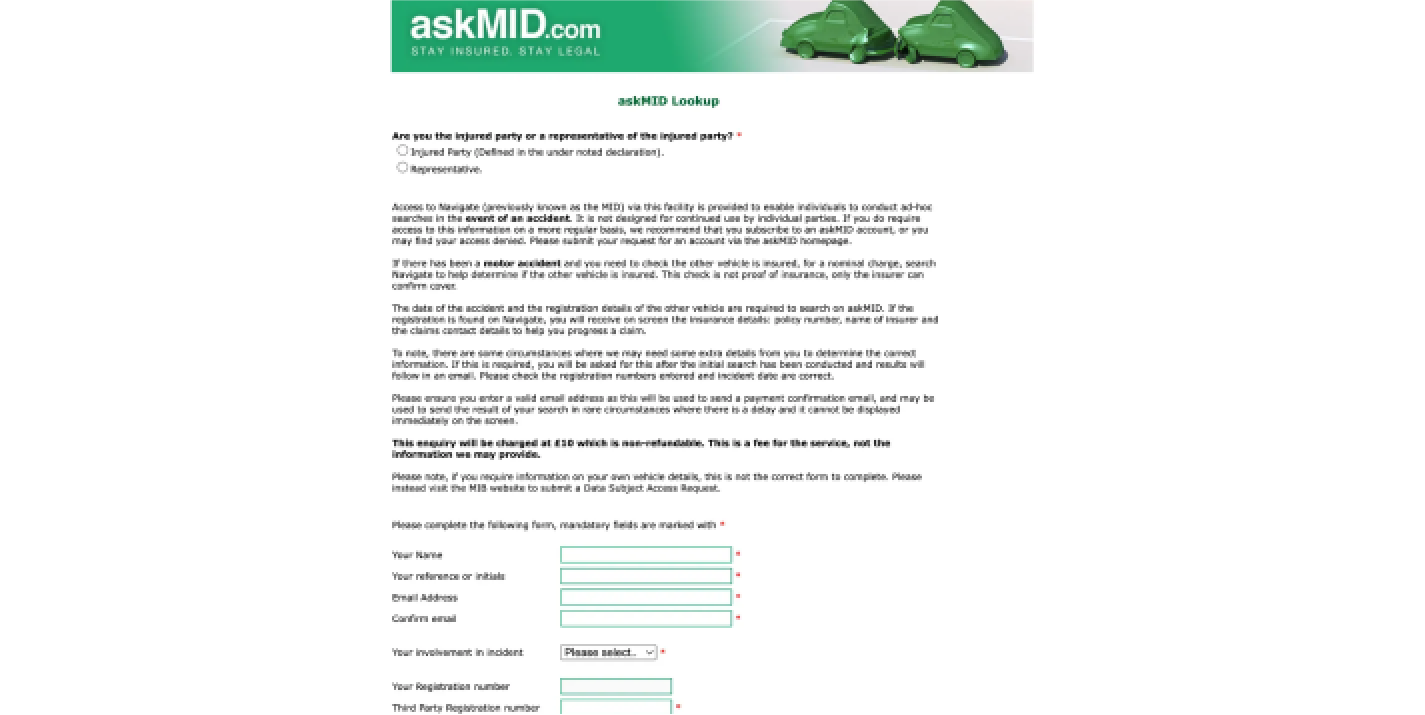

How to check another car’s insurance after an accident

You've checked the database: what happens next?

If the at-fault driver is insured

A better way to manage your non-fault claim

If the at-fault driver is uninsured or untraced

Frequently asked questions

Is askMID a legitimate website?

Why shouldn't I claim on my own insurance if I wasn't at fault?

What details do I need to make a claim after an accident?

How long does it take for the MID to update?

What do I do if my own insured car isn't on the database?

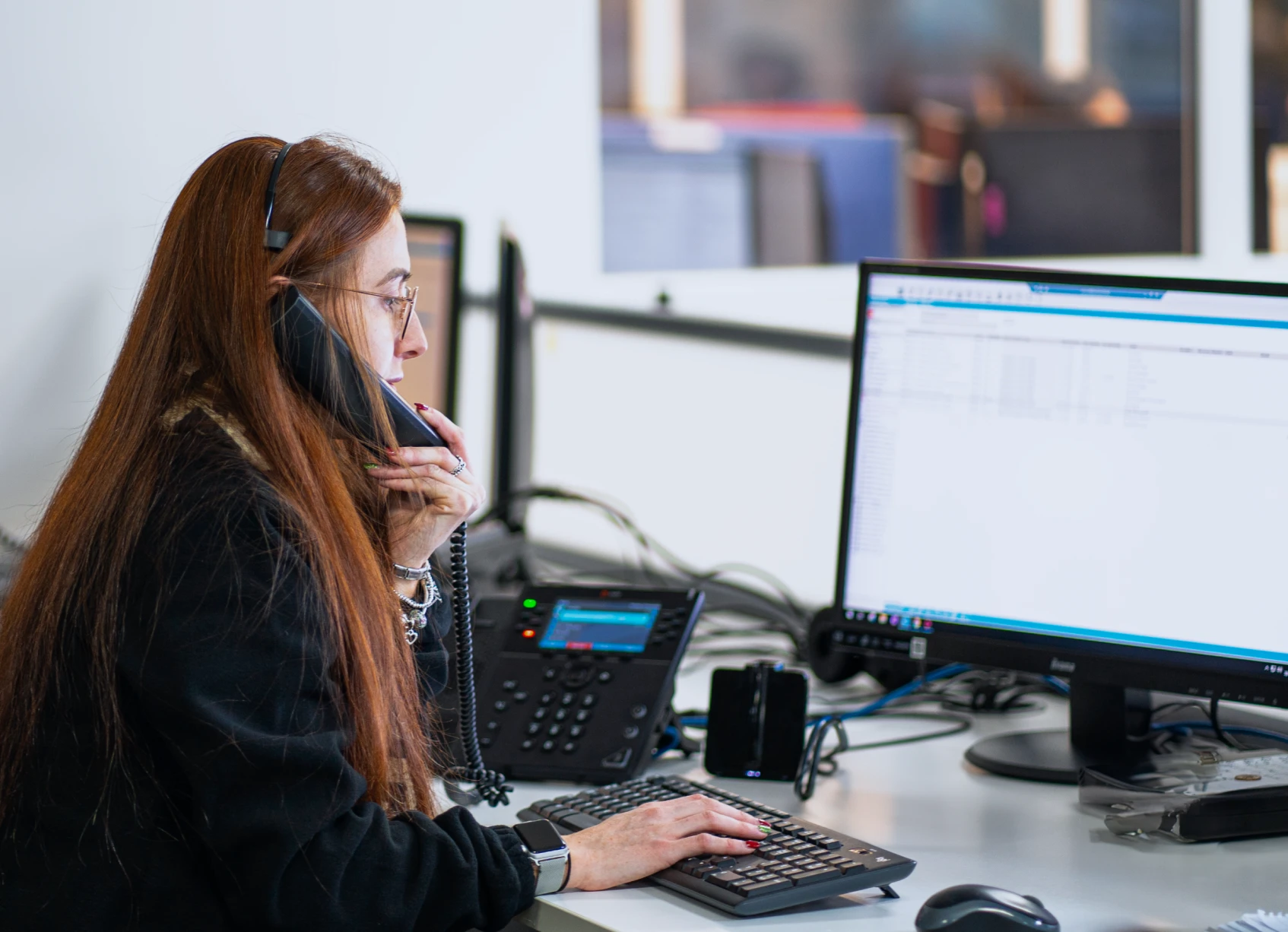

Had a non-fault accident?

Our team are ready to discuss the details of your accident and start your non-fault claim.

Call us now on 0330 128 1407

Auto Claims Assist

Advice and support when you need it most.

Related articles

/

Request a callback