My car has been written off and it was not my fault.

A car accident is everyone’s worst nightmare. Given that the accident wasn’t your fault, it feels even more frustrating. But realising that your vehicle is potentially a write-off makes this situation devastating.

You’re annoyed, exhausted and now trying to decide how best to navigate this situation, so that you aren’t left worse off. Here, we’ll guide you on how to reclaim control by initiating a non-fault claim, providing peace of mind during this stressful time.

Car written off not my fault... |

What can I find on this page?

This page provides a detailed step-by-step journey through various scenarios that happen after your car has been written off and it wasn’t your fault.

Easily navigate through this page to the information that’s relevant for you and your current situation, below. Then, follow the steps onwards for the most beneficial non fault claim process.

Who we are

Auto Claims Assist are committed to helping drivers when their car has been written off and it was not their fault.

We are an independent, trusted, award-winning Accident Management Company, specialising in non fault claims management.

All of our services are at no cost to non-fault drivers.

We manage your entire claim and provide you with a comparable vehicle replacement, until your vehicle is repaired by one of our BSI Kitemark accredited repair centres, and back on the road.

Call our new claims team on 0330 128 1407 or Start your claim now >

Understanding my situation and my next steps after a write off.

I’m at the roadside after the accident

You’ve just had the accident and it wasn’t your fault. Your car appears to be a write-off and you’re stuck roadside. You need accident recovery but you aren’t sure what to do.

I’ve not yet contacted my own insurer

It’s after the accident and you’re searching online for things like “car written off not my fault”. You’re trying to understand your next best steps, but haven’t contacted your own insurer. You’re in the right place. Your next steps are crucial.

I’ve already contacted my own insurer

Many people reach out to us at this point, as they quickly realise that contacting their own insurance is not the most beneficial option for them. Understand what to do next.

My claim has started with my insurer

You may have already started a claim with your own insurer, and now realise that this wasn’t the best idea. You want a better solution. We can provide clarity.

Start a claim with Auto Claims Assist

Auto Claims Assist are your best option after a non-fault accident. We help thousands of drivers every year. Don’t opt for second best, start your claim with us.

I have not yet contacted my insurance company.

As a non-fault driver, not contacting your insurance at this point is beneficial to you.

A lot of driver’s have the misconception that phoning your own insurance company, after a non-fault accident, is the standard thing to do.

However, it is not. By contacting your own insurance company, you essentially initiate a claim against your own policy, rather than that of the driver’s who was at fault.

This put’s your own policy at risk from multiple factors.

Read More +To process the claim, your insurer will usually request for non-fault driver’s to pay their own policy excess, as this is being processed through the non-fault driver’s own policy.

How we do it differently: With Auto Claims Assist, we don’t claim against your own policy and, therefore, no excess is required to be paid. There are no costs to you for working with us on your non-fault claim.

Your no claims bonus may be affected on renewal due to the claim that has been initiated against your policy. This will continue until liability has been accepted by the other driver’s insurer and all costs are accepted by the other side.

How we do it differently: We initiate your non-fault claim against the at-fault driver’s insurance policy for you. We keep your insurer informed on your behalf; but the claim is never associated with your policy, protecting your well-earned no claims bonus.

While the claim is pending on your own policy, it’s likely that your insurance renewal may come around. If this happens, it may cause an increase in your premiums. This is due to the unresolved accident claim that has been made against your own policy.

How we do it differently: By leaving your policy untouched, Auto Claims Assist avoid the risk of your insurance premiums rising from the non-fault accident.

I am at the roadside.

At Auto Claims Assist, we provide roadside recovery at no cost to non-fault drivers. Learn about roadside recovery after an accident that wasn’t your fault, safety at the roadside and evidence to collect for a successful non-fault claim with us.

I am not at the roadside anymore.

Reconvening after the accident, to process what has happened and how to move forward, is a sensible option. Like many people, you may be searching online for information to decide on your best option. Discover the process from here, learn all about written off vehicles and feel confident in initiating your non fault claim successfully.

I am at the roadside.

Accident recovery at the roadside.

The Importance of getting Accident Roadside Recovery.

In the immediate aftermath of a car accident, safety becomes the paramount concern. When your vehicle is written off, it may not only be undriveable but could also pose a potential hazard to other road users.

At the roadside, you may also have passengers, family or friends, who aren’t in a safe or comfortable location. In this scenario, everyone involved wants to be away as quickly as possible.

This is where accident roadside recovery comes into play. Choosing an effective accident recovery operation is critical.

- It helps remove the damaged vehicle from the road, mitigating the risk of further accidents caused by the wreckage.

- It provides immediate relief to the driver, who can focus on their own wellbeing and the wellbeing of their passengers, rather than dealing with the complicated process of vehicle recovery.

- Professional recovery ensures that your vehicle is handled with care, preserving any evidence of the accident for potential insurance claims and legal purposes. This also avoids any extra, unnecessary damage to the vehicle.

How much will recovery cost me?

One common worry for non-fault drivers is the potential unknown cost of roadside recovery.

Asking your own insurer to recover your vehicle may likely lead to the recovery costs being temporarily allocated to your own insurance policy, initiating a pending claim. This could therefore affect your insurance premiums.

The good news is, there is a dedicated option for non-fault drivers.

Accident management companies, like Auto Claims Assist, provide the non-fault accident solution to roadside recovery. We understand that a road accident is stressful enough, without the added worry of recovery costs. So, we remove that worry.

Accident roadside recovery with Auto Claims Assist is at no cost to the non-fault driver. We claim all recovery costs back from the at-fault driver’s insurance policy, on your behalf.

Accessing Roadside Recovery, at no cost to you.

When considering whether or not your vehicle is ok to drive away from an accident scene, your safety and the safety of your passengers should be the number 1 priority.

Calling Auto Claims Assist for roadside recovery is a step towards keeping everyone safe.

You don’t want to delay the decision to call for assistance for too long; leaving yourself, your passengers and your vehicle exposed in a potentially unsafe place.

So, when you find yourself at the roadside after an accident, your first point of contact should be Auto Claims Assist.

Our 24/7 dedicated accident recovery team is always ready to coordinate a professional non-fault recovery, ensuring you receive swift assistance. All you need to do is call us on 0330 128 1407, and we'll take care of the rest at no cost to you.

Our professional roadside recovery team are instantly dispatched to you after your call to us.

Need recovery? Call us now on 0330 128 1407

Roadside Safety.

The first priority must be everyone’s physical safety.

Carefully evaluate your own physical condition. Look for any visual physical injuries and focus on how you are feeling; try to notice pain or anything that doesn’t feel quite right. It’s possible that you’re in shock after the car accident and any pain hasn’t yet set in yet (Understand what shock is).

Move on to evaluating any passengers physical conditions. Allow them to see how they are feeling.

If anyone is injured, call an ambulance.

An ambulance can provide the closest thing to immediate medical attention if no witnesses/passers by are medically trained. Although an initial examination of an injury might not seem life-threatening, car accidents can cause a variety of injuries, some being fatal. Determining how serious an injury is can sometimes be challenging as the severity of the injury may not be immediately apparent.

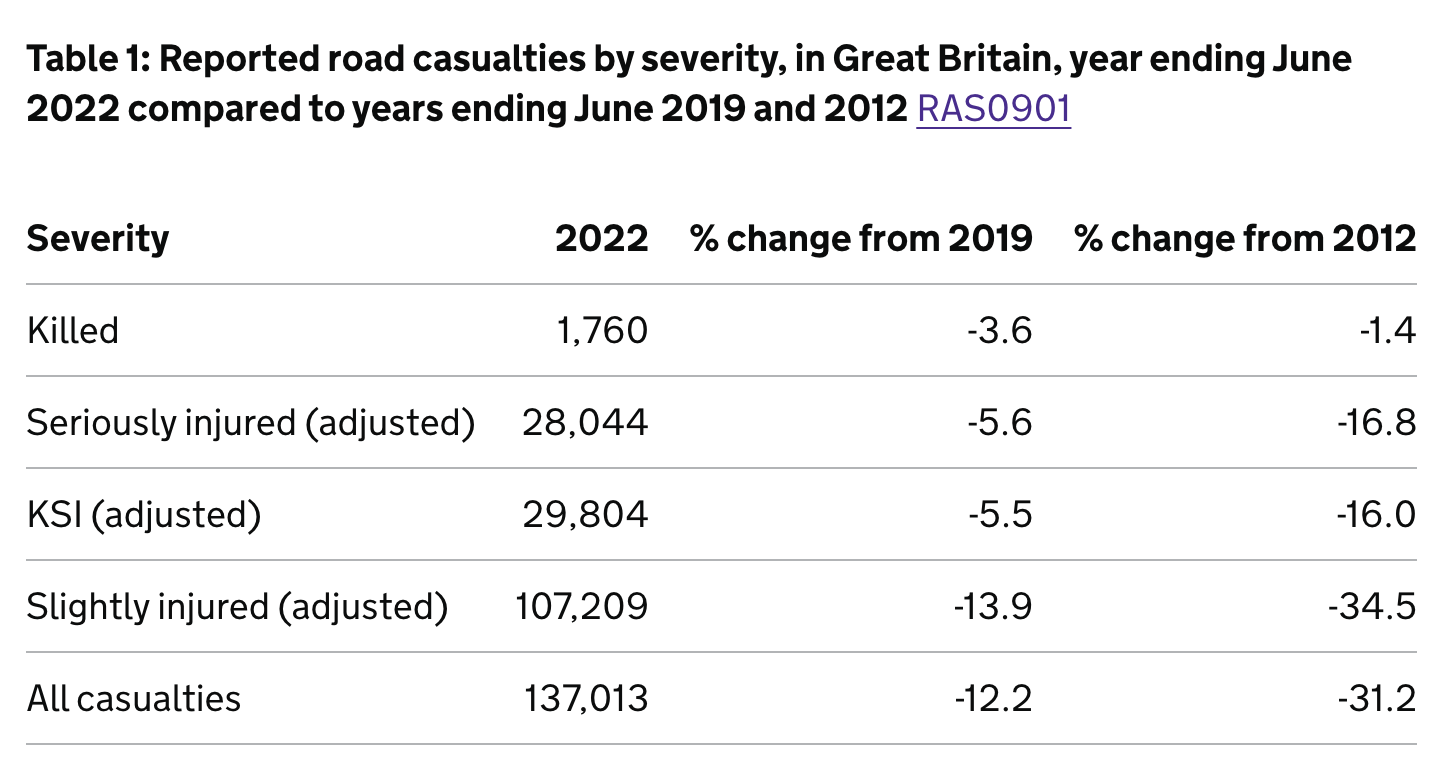

The UK government reported on the 2022 provisional estimates of road casualties in Great Britain, stating that there were:

- 1,760 fatalities in reported road collisions.

- 29,804 reported killed and seriously injured (KSI) casualties.

- 137,013 reported casualties of all severities.

By calling an ambulance, the on-scene paramedics have a better chance of providing a more accurate diagnosis, quicker. As well as this, the paramedics have the opportunity to administer the correct treatment for anyone who is injured. This is a much safer and more effective option than not calling an ambulance and waiting.

If hospital care is required, an ambulance will also provide faster and safer transport access to the most suitable hospital for any injuries. They can also alert the hospital in advance so that appropriate medical staff and resources are ready upon arrival.

Finally, for everyone’s safety, secure the accident area

Collecting evidence of the accident scene in it’s final state is important for a successful non fault claim. However, once this has happened (See ‘Evidence’ for more information on this), consider trying to move your vehicle to the side of the road, or to another safe spot. This is to help prevent any further accidents - if you had experienced a motorway accident, for example, or a busy main road.

If the car is undriveable, as a result of it being a write-off, turn on the vehicle’s hazard lights and place warning triangles, if available. This will alert other road users and help keep a safe distance from flowing traffic.

Collecting Evidence.

Document the Incident

Knowing what to do in a car accident is important for when you come around to making a non-fault claim afterwards. A well self-documented incident report goes a long way when arguing liability with the other driver’s insurance.

Even though the accident wasn’t your fault; it doesn’t mean that the other driver will accept this as the case. So, make clear notes there-and-then, detailing how the accident occurred and how it was the other driver’s fault. This includes:

- Using your smartphone or camera to take pictures of:

- The accident scene

- Positions of the cars involved

- Visible damage

- Skid marks

- Road signs

- Any other relevant conditions

- Consider drawing out how the accident happened

- Consider capturing video footage, to further evidence all of the above

- Collect witness reports

- If emergency services were called to the scene, the official record of an ambulance call and the subsequent medical treatment can serve as evidence

All of this can provide critical evidence if the fault of the accident is contested later.

Exchange Information

If you are involved in an accident that causes damage or injury, the legal expectation is to provide the following, as a minimum, to anyone with ‘reasonable grounds for requiring them’:

- Your name

- Your address

- The vehicle registration number

If the owner of the vehicle is not yourself, you also need to provide the owners name and address.

This, of course, also applies to the other party involved.

Even if it's a non-fault accident, our suggestion would be to exchange as much information as possible (within reason), this being:

- Contact details

- Driver's license number

- Insurance details

- And vehicle information (make, model, colour)

- Any witnesses contact details

With this additional information, it will make the claim process smoother and quicker.

Avoid Unnecessary Confrontation

Although this section is about ‘Evidence’, it’s important to remain calm and avoid arguing with the other driver(s) about the fault of the accident.

Arguments and confrontation can escalate tension at the scene and may complicate matters legally.

If the situation is tense and has a potential of escalating, it is better to collect as much evidence as possible. Then, leave liability (fault) discussions to be handled by the insurance companies and legal parties (if necessary).

Don’t apologise

lot of us may feel it instinctive to apologise after a car accident to the other person.

However, saying "I'm sorry" can be perceived as an admission of guilt or liability, even if that was not your intention. Insurance companies or courts may interpret your apology as accepting fault for the accident, which could affect the outcome of insurance claims or legal proceedings.

If the other driver apologises for the accident, consider making note of exactly what is said.

I am no longer at the roadside.

The Accident Process.

The Process

At this part of the journey, you're away from the roadside and in a safe location.

The immediacy of the accident has passed, but the questions and uncertainty are likely to be lingering.

Maybe you’re at home, or at work, searching for what to do next and ‘car written off not my fault’. You are most likely wanting to understand what is the best way to navigate this situation.

Progressing through the insurance claim, accurately organising a temporary replacement, dealing with settlement figures and understanding your rights can feel like a lot to handle. It can be.

However, we want you to know that you're not alone.

As a professional accident management solution, we're here to help you through this complex process step-by-step:

Step 1 - Contact Auto Claims Assist, Your Accident Management Experts:

This is your first step towards getting professional help to handle your claim. Choosing a reputable accident management company with positive customer feedback and experience is important.

At Auto Claims Assist, our accident experts will guide you through a transparent process; explaining each next step to you clearly.

Step 2 - Provide All Necessary Information:

Over the phone, your new claims handler will need detailed information about the accident, along with the details of any parties involved.

This includes: Accident conditions, time of accident, location of accident, weather conditions, traffic signs, vehicle damage, injuries, and the details of all drivers and witnesses.

Keep in mind, the more information you can provide, the better they can assist you.

Step 3 - Replacement Vehicle:

It’s your understanding, at this point, that your car might be a write-off. So, it’s most likely to be unroadworthy.

For most, having a vehicle can be essential for your day-to-day life. Not only that, but the specification of your vehicle might also be essential to your routine and requirements.

So, as the non-fault driver, it’s only fair that a replacement vehicle is provided to you. It’s also only fair that the type of vehicle you receive should be comparable to your own.

Therefore, at no cost to you, we provide a like-for-like replacement vehicle from within 4 hours of contacting us; ensuring you’re not left without.

This will be delivered to you, fuelled up (or charged, if it’s electric) and ready to go.

Step 4 - Vehicle Assessment:

We’ll recover and store your vehicle for you. This is before one of our trusted, independent professional assessors inspects your vehicle. This will determine if your car is a total loss.

During this assessment, they will consider the cost of repairs and compare it to the car's pre-accident market value.

If repair costs are higher than the car's value, it'll be declared a write-off. Sometimes, a car might be considered beyond repair for safety reasons. For instance, if the car's frame or structure is significantly compromised, it might not be safe to repair then drive the vehicle, even if the cost of repairs is less than the vehicle's PAV (Pre-accident value).

Step 5 - Handling of Your Non Fault Accident Write-Off Claim:

Within our team at Auto Claims Assist, we have Monitoring Claims Handlers. From this team, you will be assigned your own dedicated claims handler.

Your claims handler will manage your claim from start-to-finish for you, and will negotiate with the insurers on your behalf.

This is an important part of the process and involves proving who was at fault, determining the cost of damages, and working towards a satisfactory settlement.

Step 6 - Personal Injury and Legal Assistance:

Legal support may be necessary if there are disputes about liability, or if you have suffered any personal injury as a result of the accident.

As part of our claims management service, we coordinate this for you, with our panel of specialist accident and personal injury solicitors.

We’ll ensure you aren’t left to worry about any legalities of a non fault car written off accident.

Step 7 - Finalising Your Claim And Claim Settlement:

The goal of the claim process is to make sure you are compensated fairly for your loss. This typically means a payout equivalent to the pre-accident market value of your car, or enough to replace your car with a similar make and model.

The claim settlement is the final amount agreed upon between you (us) and the insurance company of the at-fault driver.

We fight for you, on your side, for liability and a fair settlement payout. We also ensure that the full agreed settlement is recovered, as quickly as possible.

Once this is paid, you can replace your vehicle and move on from the incident. Our mission is to make sure this process goes smoothly, swiftly and, most importantly, fairly. We help to reduce the impact that a non-fault accident can have on your life, as much as possible.

Fees and Costs: There are no costs or fees to you for using our service. We carefully track all of the costs that are incurred for you during the claims process and claim this back against the at-fault driver’s insurance policy.

Follow-up Support: We believe that our responsibility doesn't simply end with the conclusion of the journey. We will stay in touch, even after your case is closed, to make sure you've been able to successfully replace your vehicle and that you are satisfied with their service.

Afterwards, we’re always here for advice on how to handle any potential issues in the future.

Ready to begin your non-fault claim process?

Call our new claims team on 0330 128 1407 | Start your claim now >

About written off vehicles.

What is the definition of a ‘written off car’?

A "written off" car refers to a vehicle that has been severely damaged to the point where it's either:

a. Unsafe or

b. Uneconomical to repair

There are generally two types of written off cars:

- Economical written-off: When the cost of repairing the vehicle exceeds a certain percentage of the vehicle's pre-accident value (PAV) (often around 60-75%), it's considered an economical write-off. Even though the car might be repairable, it doesn't make financial sense to do so.

- Structural written-off: If the car's structural integrity has been significantly compromised - for example, the chassis is severely bent or twisted - it's usually considered a structural write-off. This means it's unsafe to repair and put back on the road.

In both cases, the car's insurer will typically declare the vehicle a total loss and compensate the owner based on the vehicle's pre-accident value (PAV).

After this, the written off vehicle is typically sent to salvage.

Is a ‘total loss’ different to a ‘write-off’?

The terms 'total loss' and 'write-off’ both describe a circumstance where a vehicle has sustained such severe damage that it's deemed either financially impractical or unsafe to undertake repairs.

However, there can be a subtle difference in meaning depending on the context:

Total Loss: This term is often used by insurance companies when the cost of repairing the vehicle exceeds its pre-accident value (PAV), or a significant percentage of it. When a vehicle is declared a total loss, the at-fault insurance company will typically provide a settlement for the amount that equals to the cars market value prior to the accident, rather than paying for repairs.

However, it’s common for insurance companies to offer less on their settlement than the true market value of a vehicle. This is why we at Auto Claims Assist fight for a fair market-value settlement for our customers when they choose to claim with us.

Write-Off: This term is also used when a vehicle is damaged beyond economical repair, but it can also refer to situations where the vehicle is repairable, but is considered too unsafe to go back on the road. This is usually due to the nature of the damage.

The categories of a written off car

In the UK, when a vehicle is declared a total loss or "written off", it's categorised by the insurer into one of four write-off categories based on the extent of the damage.

Category A (Cat A): The vehicle is so badly damaged that it must be completely scrapped; no parts of it can be reused. The vehicle is deemed a total loss in every sense of the term, and there's no option for salvage. Cat A vehicles may have been subjected to devastating damage, such as from a serious accident or a fire.

Category B (Cat B): This is for vehicles that have sustained severe damage, to the extent that they should never return to the road. However, there might be some parts that can be salvaged and reused in other vehicles. The shell of the vehicle must be destroyed and cannot be resold. This category is generally for vehicles with severe body damage, although some key components may be salvageable.

Category S (Cat S, previously Cat C): Previously known as Category C, Cat S is for vehicles that have suffered structural damage, like a bent or twisted chassis, or extensive damage to crumple zones. While it's possible to repair these vehicles, the cost of doing so is deemed uneconomical by the insurer, usually because it would exceed the vehicle's value. After repairs, the vehicle must undergo a Vehicle Identity Check by the DVLA before it can be driven again. The Cat S designation will be marked on the vehicle's history, which could affect its future value.

Category N (Cat N, previously Cat D): Previously known as Category D, Cat N is for vehicles that haven't sustained structural damage, but other issues make repair uneconomical for the insurer. This could include expensive internal damages, electrical faults, or safety-related issues. Unlike Cat S, there's no requirement for a Vehicle Identity Check by the DVLA before the car is back on the road, but the Cat N designation will remain on the vehicle's history, which may lower its resale value.

These categories are designed to provide clear information about the severity of the damage a vehicle has sustained. They're particularly relevant for people considering buying a used car, as any vehicle that's been written off will have the ‘write-off’ category listed in its history. This can affect the vehicle's value and insurability.

Why was category C changed to Category S?

In the UK, the category formerly known as Category C was replaced by Category S in October 2017. Category C was used to denote vehicles that had suffered significant damage, typically requiring repairs that exceeded the vehicle's value. These repairs would have included both structural and non-structural damage.

However, the Association of British Insurers (ABI) revised the write-off categories in 2017 to improve clarity and transparency. As part of this revision, Category C was reclassified as Category S, and the definition of the category was refined. Category S (which stands for "Structural") now specifically applies to vehicles that have suffered structural damage, such as damage to the chassis or frame.

The change from Category C to Category S was primarily made to emphasise the importance of structural integrity and to provide more accurate information about the nature of the damage sustained by the vehicle. The revised categories aim to assist potential buyers in making informed decisions about the history and condition of vehicles that have been involved in accidents or suffered significant damage.

Why was category D changed to Category N?

In the UK, the category formerly known as Category D was replaced by Category N in October 2017. Category D was used to designate vehicles that had suffered damage that the insurer deemed uneconomical to repair, but the damage was primarily non-structural.

However, the Association of British Insurers (ABI) revised the write-off categories in 2017 to improve clarity and transparency. As part of this revision, Category D was reclassified as Category N, and the definition of the category was refined. Category N (which stands for "Non-Structural") specifically applies to vehicles that have suffered non-structural damage, such as electrical faults, issues with safety features, or other types of damage that make repairs uneconomical.

The change from Category D to Category N was made to more accurately reflect the nature of the damage sustained by the vehicle and to assist potential buyers in making informed decisions about the history and condition of used cars. It's important to note that Category N vehicles have not suffered structural damage but were deemed uneconomical to repair by the insurer.

How a car is determined as written-off

The determination begins with a Damage Assessment. Your vehicle will be inspected to estimate the cost of repairs.

Your vehicle’s pre-accident value will then be calculated. This is typically based on factors such as:

- Make

- Model

- Age

- Mileage

- Condition

A variety of resources are used to do this, such as:

- Price guides

- Local sales data

- Online listings for similar vehicles

The estimated repair cost will then be compared to the vehicle's pre-accident valuation. If the cost of repairs exceeds a certain percentage of the vehicle's value (the specific percentage can vary), the vehicle may be classified as a write-off. The cutoff percentage is typically somewhere between 50-100% of the vehicle's value, (usually around 70%). This depends on the organisation that is determining the write-off and their policies.

Finally, based on the findings and comparison, a determination will be made to repair the vehicle or classify it as a write-off.

This write-off assessment should be completed by an engineer that has access to the vehicle. Sometimes, insurance companies have been known to provide a write-off determination over the phone without accessing the vehicle.

In order for your vehicle to have an independent, thorough assessment, non-fault drivers should contact an accident management company, such as Auto Claims Assist. We have a network of BSI Kitemark accredited accident repair garages and engineers who provided a detailed and accurate write-off determination, at no cost to the non-fault driver.

To start your vehicle’s write-off determination, get in touch with us today on 0330 128 1407 or Start your claim now >

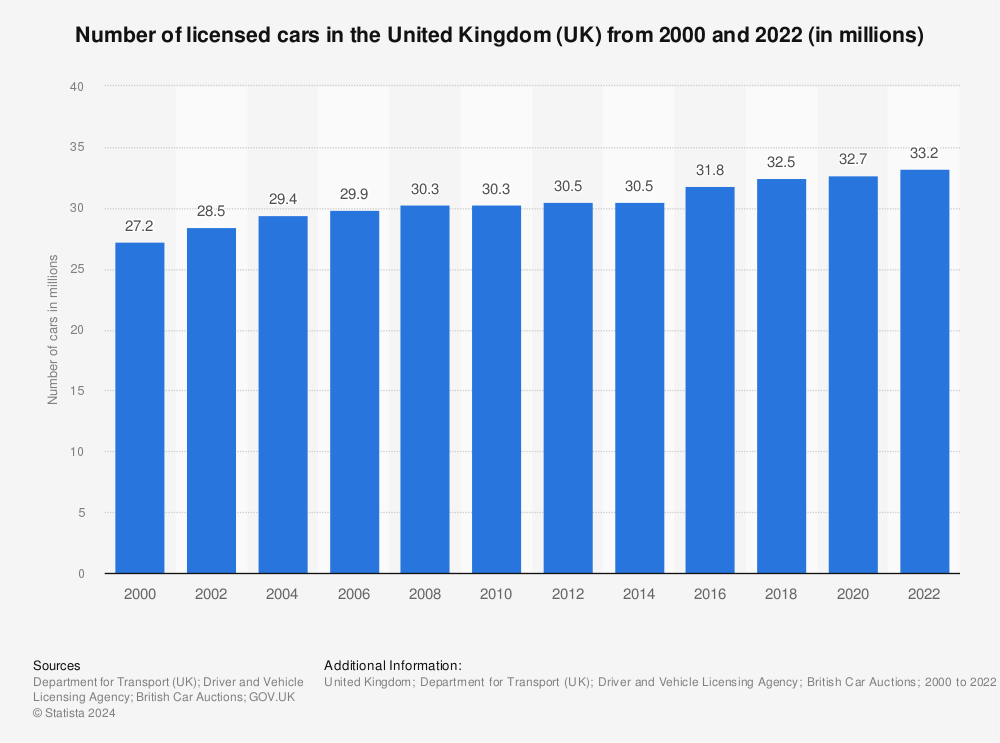

Is the number of written off cars increasing or decreasing in the UK?:

Road traffic accidents are the most common reasons why cars are written off.

Data shows that the number of licensed cars over the the two decades spanning 2000 - 2020 had an consistent increase in registered UK vehicles.

Source: Statista

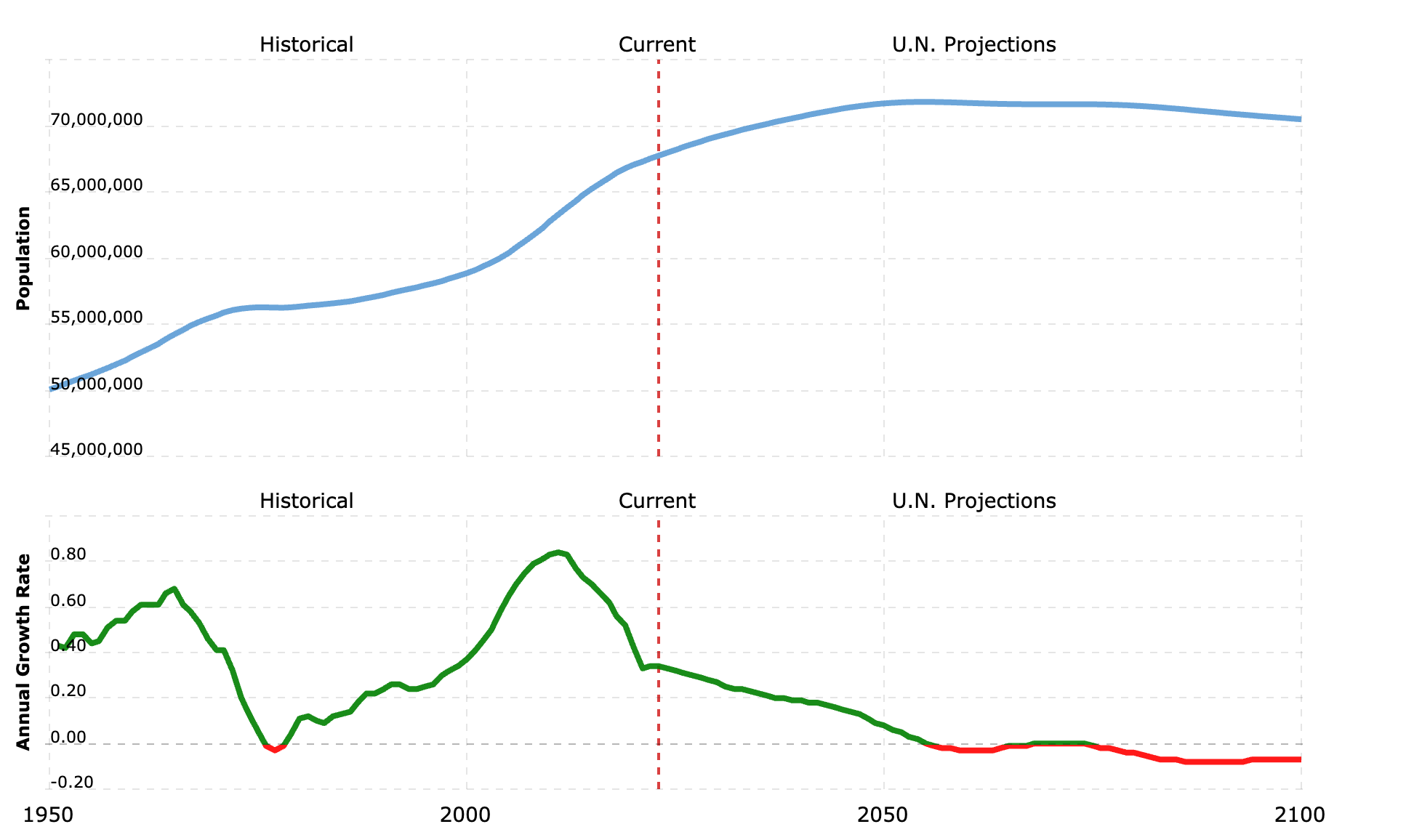

The increase in registered vehicles in the UK matches the increase in UK population. This increase in population shows a potential link between this and more people being on the roads. This increase is estimated to continue through past the year 2050:

Source: Macrotrends

Source: Macrotrends

However, given the clear increase in UK population and registered road users, the number of reported road casualties in Great Britain is not increasing. Instead, the total number of causalities has been declining, with a consistent decline spanning back over two decades between 2012 - 2022:

Source: Gov UK

Source: Gov UK

While there are no public records for the official number of written off vehicles in the UK, this data suggests that road traffic accidents are potentially decreasing, or at the very minimum, the seriousness of accidents are reducing. This might suggest that the ratio of written-off vehicles is also decreasing with it.

On the contrary, however, newer vehicles with more complex technology is leading to a rise in repair costs. This is down to the technology being used and the labour required to fix certain types of technology.

One example of this is a report by Reuters, which describes how for many electric vehicles, there is no way to repair or assess even slightly damaged battery packs after accidents, forcing insurance companies to write-off cars with few miles - leading to higher premiums and undercutting gains from going electric.

We can see that technology helps to reduce car accidents. This is visible in the road traffic accidents data from the UK Government. However, the same technologies are also causing vehicles to be written-off earlier than they might have otherwise been due to them not being economically viable to repair.

As a conclusion, we may see this result in the number of written off cars overall increasing rather than decreasing.

Start a non fault claim.

We understand how frustrating and stressful these situations can be, and we're here to help you navigate the process and get you back on the road as soon as possible.

By choosing to start a non-fault claim with us, you can benefit from our comprehensive suite of services designed to make the claim process smooth, efficient, and hassle-free. Here's how we can help:

- Effortless Claim Process: We handle the entire claim process on your behalf, liaising with insurance companies, repairers, and other parties involved.

- Replacement Vehicle: We can arrange for a like-for-like replacement vehicle for the entire duration that you are left without. This is while your vehicle is being evaluated or until your payout is received, as a result of your written off not my fault.

- Legal Support: Our expert panel of legal professionals can provide guidance and support for any legal concerns that may arise during the claim process.

- No Impact on No Claims Discount (NCD): As we recover costs from the at-fault party's insurer, your NCD is not affected.

- No Upfront Costs: There is no cost to our non-fault drivers. The liability of all costs associated with the claim are re-claimed from the at-fault driver’s insurance policy. There’s no excess to pay upfront and no costs to pay throughout.

Starting a non-fault claim with Auto Claims Assist is simple and straightforward. You can call our dedicated team of claim specialists at 0330 128 1407 to discuss your situation and initiate your claim.

If you prefer to start your claim online, you can fill out our easy-to-use Non-Fault Claim Form here. Just provide the required information, and one of our claims advisors will be in touch to guide you through the next steps.

Auto Claims Assist are committed to making your claim process as simple and efficient as possible. We provide professional support at every step. Don't let a non-fault accident disrupt your life - contact us today and let us help you navigate your claim with ease.

I have contacted my insurer.

After an accident, calling your own insurance is typically a knee-jerk reaction that lot’s of drivers do. If you’ve contacted your own insurance, you can still use an accident management company at this point, providing that your claim isn’t in progress. You’ve likely searched Car written off not my fault with the intention of understanding your situation. We can provide the clarity that you need.

I have not started my claim.

Before initiating a claim with your insurer, ensure you have a full understanding of the options that are available to you. You should choose the route that is most beneficial to you. Plan your next steps with a full understanding.

I have started my claim.

If you have already started your claim, you may still have other options at the stage, depending on where you’re up to in the claim. If your vehicle has been taken by your insurer and you’re already in a courtesy car, use this section to answer any questions you might now have.

I have not started my claim.

Insurer’s policy excess charge.

Paying your own policy excess to start a non-fault claim

You’ve spoken to your own insurance company, after an accident that wasn’t your fault, and they’ve asked you to pay your policy excess.

When you make a claim on your insurance policy, it's standard practice for the insurer to ask you to pay your excess, regardless of whether you were at fault or not in the accident.

However, as the non fault driver, you shouldn’t need to pay an excess if it wasn’t your fault.

Why do they ask me to pay my excess?

At the outset of a claim, the facts surrounding the incident are usually not yet fully known. Your insurer has a duty to respond promptly to your claim, and will begin the claims process for you.

In order to process your claim without a determined liability of fault, they do so on your own insurance policy. This is because the claim includes arranging for repairs and providing a courtesy/hire car.

Until liability has been determined between the insurance companies, your own policy receives a pending claim and is liable for all associated costs.

Will I get my excess back?

Providing it is later determined that the other party was at fault and they have insurance, your insurer will seek to recover the costs of the claim from the other party's insurer. This includes the amount of your excess. This process is known as subrogation. Only after these costs are successfully recovered will your insurer reimburse your excess.

However, it’s for this reason that it is important for your claim to be handled by dedicated, non-fault experts who are on your side.

If liability is not won, your own insurance policy will have liability for the final claim costs. This will cause significant impact to your own insurance policy, premiums and no claims bonus.

You won’t pay an excess with Auto Claims Assist

Rather than initiating a claim against your own insurance policy, Auto Claims Assist claims directly against the third parties insurance policy for you. This avoids the need to pay your own policy excess.

We fight for liability on your behalf

Our team is experienced in handling claims and is well-versed in insurance and traffic laws. We use our knowledge and experience to establish liability accurately, arguing your case with sound reasoning and solid evidence.

If there's a dispute about who's at fault in the accident, we don't shy away from the challenge. We'll scrutinise the facts, gather and analyse evidence, and build a robust case to challenge any unfounded claims of liability on your part.

We also handle all the direct communication, negotiations, and paperwork for you, ensuring your case is presented in the best possible light.

As our client, you're our top priority. We represent your interests throughout the entire claim process, ensuring that you're treated fairly and that your rights are protected.

Is my car a write off?

Finding out that your car might be a write-off, without a physical assessment of the damage, can be a tough pill to swallow. Especially if you've only been informed of this over the phone by your insurer at this point.

You may be questioning whether your vehicle is actually a write-off, and what to do next. Read below why insurers might initially consider your car a write-off, and whether they could be mistaken:

How Insurance Companies Make Preliminary Assessments

When an accident occurs, you typically notify your insurer as soon as possible, describing the circumstances and the extent of the damage. Based on your description, the insurance representative may make an initial judgement about whether your car is likely a write-off. They typically use their experience, general knowledge of vehicle repairs, and the details you provide to make this judgement. This is by no means a definitive conclusion, but rather a preliminary assumption that is subject to further verification.

Could the Insurer Be Wrong?

Yes, it is possible. A physical assessment is crucial because damage to a vehicle can sometimes be more or less severe than it initially appears. For example, what may seem like a minor exterior dent could mask significant structural damage, or what appears to be a total wreck might have parts that can be salvaged, making repair a viable option. So, an insurer's preliminary assessment can change following a detailed inspection.

What Should I Do Next?

If you're unsure about your insurer's initial judgement, you should consider an independent assessment of the damage. An independent assessment can provide peace of mind or an alternative perspective.

By consulting an accident management company, such as Auto Claims Assist, you can receive professional guidance on your situation.

While your insurer's initial assessment can provide an indication of whether your car is a write-off, it's not definitive until a physical inspection has been carried out. There are no cost to you for the privilege in working with Auto Claims Assist.

The better alternative option at this point.

If you've recently been involved in a non-fault accident, and you're navigating through the aftermath, it's essential to consider all your options before proceeding with a claim. While contacting your insurer is a natural first step, it's not always the best or only solution.

A more advantageous alternative could be working with an accident management company like Auto Claims Assist:

- No Upfront Excess Payment: When you file a claim with your insurer, you typically need to pay your policy excess upfront, even if the accident wasn't your fault. In contrast, Auto Claims Assist makes a claim directly against the at-fault party's insurance, meaning there's no need for you to cover the excess.

- Preserving Your No Claims Discount: With Auto Claims Assist, your No Claims Discount remains unaffected since the claim is not against your own policy. This is an advantage you might not have when filing a claim with your insurer, depending on your policy terms.

- Hassle-Free Claim Management: We handle all aspects of the claim process for you - from communication and paperwork to liaising with insurance companies and other involved parties. This reduces the stress and burden on your end, allowing you to focus on more important things.

- Expert Representation: Auto Claims Assist fights for your liability, using our expertise to ensure that your rights are protected and your claim is fairly assessed. If there's a dispute about who's at fault, we'll gather and analyse evidence, ensuring a robust case is built on your behalf.

- Replacement Vehicle: We understand that being without a car can disrupt your daily life. That's why we arrange for a like-for-like replacement vehicle while your claim is being processed, minimising any inconvenience to you.

Turning to Auto Claims Assist after a non-fault accident provides a more streamlined, stress-free, and efficient claims process. We're here to guide and support you every step of the way, ensuring that your best interests are at the heart of everything we do.

To start the process, get in touch with our dedicated New Claims team on 0330 128 1407 or start a claim online now. Don't let a non-fault accident complicate your life. Let Auto Claims Assist handle the complexity while you get back on the road.

I have started my claim already.

Considerations at this point.

Can I cancel my claim with my insurer and claim with Auto Claims Assist

If you've initiated a claim with your own insurance company, you might be wondering whether you can cancel that claim and switch to claim with Auto Claims Assist instead.

The ability to do so largely depends on how far along in the claims process you are with your insurer.

Your Vehicle Has Been Taken, and You've Received a Courtesy Car

If your insurer has already taken possession of your damaged vehicle and you're using a courtesy car provided by them, it's likely that you're already too far into the claims process to cancel and switch. In this case, you're probably best to continue with your existing claim.

You've Started a Claim, But Your Vehicle Hasn't Been Taken Yet

If you've technically initiated a claim with your insurer but they haven't yet taken your vehicle for inspection or repairs, and you haven't received a courtesy car, it's generally possible to cancel your claim. In this situation, you can contact your insurer, advise them you wish to cancel the claim, and then initiate a non-fault claim with Auto Claims Assist.

It's important to note that the ability to cancel a claim can depend on the specifics of your insurance policy, so you should confirm your options directly with your insurer. If they agree to cancel the claim, ensure you receive confirmation of the cancellation in writing.

What if my car is on finance and is written off

If your car is on finance and becomes a write-off, this can lead to some additional complexities, but it's a situation that is fairly common and has well-established procedures.

When your car is written off, your insurance company typically pays you the pre-accident market value of the car. If your car is under finance, the payout first goes to your finance company to settle the outstanding loan. If the payout amount is less than your outstanding loan, you will still be liable for the balance, and you would need to continue making payments until the loan is fully repaid. This situation is known as being "upside down" or "underwater" on your car loan.

However, if the payout exceeds the balance of the loan, the excess amount will be paid to you. You can use these funds towards a deposit for a replacement vehicle, if you wish.

How Gap insurance can help with finance

To protect against the possibility of a shortfall, some people take out GAP insurance (Guaranteed Asset Protection). This is usually an optional extra insurance coverage that can be beneficial in the event of a write-off or total loss of your vehicle.

GAP insurance can cover the difference between the insurance payout and the remaining balance on the loan in the event the vehicle is written off.

GAP insurance can cover the difference between the insurance payout and the remaining balance on the loan in the event the vehicle is written off.

If your car has a personalised number plate

If your vehicle is declared a write-off and you have a personalised number plate (also known as a private registration plate or cherished plate) assigned to that vehicle, you have options for retaining the plate.

It's important to note that you need to take action to retain or transfer your personalised number plate before the vehicle is officially written off.

Once the vehicle is scrapped or sold for salvage, it may become more challenging or impossible to retain the plate.

The V778 Retention Document is a form issued by the Driver and Vehicle Licensing Agency (DVLA) in the UK. It is used for the retention of a personalised number plate when it is being removed from a vehicle, including in the case of a write-off.

Telling the DVLA about your written off vehicle

If your vehicle has been declared a write-off, it is important to inform the Driver and Vehicle Licensing Agency (DVLA) in the UK about the status of your vehicle.

- Complete the Notification of Vehicle Destruction (V5C/3) section of your vehicle's registration certificate (V5C)

- After completing the V5C/3 section, send it to the DVLA

- Cancel Your Vehicle Tax and SORN (Statutory Off Road Notification)

- Return the Registration Certificate

Disputing a write off decision.

As a car owner, you may feel emotionally attached to your vehicle or believe that the damage is repairable, and thus, wish to refuse a write-off decision.

If your insurer has declared your vehicle a write-off, it's not necessarily the final word. As the policyholder, you have the right to dispute their decision if you believe it's not correct or fair.

The insurance company declares a car a write-off or total loss when the cost to repair the vehicle exceeds a certain percentage of its market value (usually between 50%-100%). This is a financial decision made to avoid the insurer paying more for repairs than the vehicle is worth.

If you disagree with your insurer's decision to write-off your vehicle, here are a few steps you could take:

- Understand the Reason for the Write-Off: Insurers typically declare a vehicle a write-off if the cost of repairs exceeds a certain percentage of the vehicle's pre-accident value. Make sure you're clear on the insurer's rationale, which they should provide you with.

- Get an Independent Valuation: If you disagree with your insurer's valuation of your vehicle, consider obtaining an independent valuation. A professional appraiser or reputable car dealership can provide this service. Remember to consider factors such as the age, mileage, and condition of your car when comparing valuations.

- Collect Evidence: Supporting your dispute with evidence can help. This could include service records, receipts for recent repairs, upgrades or maintenance, and comparisons with similar vehicles for sale in your local area. Photos of your car (both before and after the accident) can also be useful.

- Write to Your Insurer: Once you've collected your evidence, write a letter to your insurer stating that you disagree with their decision. Include the reasons for your disagreement and any evidence to support your case. It's recommended to send this letter via registered post or email to ensure there's a record of it.

- Escalate if Necessary: If your insurer maintains their decision and you still disagree, you can escalate your dispute to a higher authority. In the UK, this would be the Financial Ombudsman Service (FOS). The FOS will review your case independently and make a decision, which is usually binding on the insurance company.

- Consider Retaining the Salvage: If your insurer is still not willing to repair the vehicle, and you believe it's repairable, you can consider buying the car back as salvage. But remember, you'll have to bear the cost of repairs, and there could be challenges in insuring and registering a car with a salvage title.

Overall, keep in mind that safety is a paramount concern. If your car was deemed a total loss due to safety reasons, it might not be wise or even legal to put it back on the road without substantial repairs.

It's always best to consult with your insurance company, legal professionals, and/or a trusted mechanic to understand your options and the potential consequences.

Disputing an insurers write off’s valuation.

If your car has been declared a total loss (or 'write-off') by your insurance company, they'll offer you a cash payout based on their assessment of the vehicle's pre-accident market value.

A common perception is that insurers commonly undervalue write-offs. This, unfortunately, can be true and stems from a wide variety of reasons.

One of the most common types of complaints that the financial ombudsman service receives is how drivers haven’t been paid enough for their vehicle after a write-off.

Insurance companies use industry-standard methodologies and databases to calculate a car's value, which may not take into account every unique feature or circumstance of a particular car. For example, recent upgrades, meticulous maintenance, or lower-than-average mileage might not be fully reflected in an insurer's estimate.

This can sometimes result in a lower valuation than expected, leading to disagreements between policyholders and insurance companies.

If you believe this valuation is too low and doesn't fairly reflect your car's worth, there are steps you can take:

- Review the Insurer's Valuation Report: Start by examining the valuation report provided by the insurer. The report should detail the methods used to calculate your vehicle's value, including factors such as age, mileage, condition, and recent selling prices of similar models.

- Obtain an Independent Valuation: If you still believe the insurer's valuation is too low, consider getting an independent valuation. This could be from a professional appraiser, a trusted mechanic, or a reputable dealership. Be sure to consider the same factors as your insurer did.

- Gather Evidence: Provide evidence to support your claim for a higher valuation. This could include recent receipts for any improvements or repairs made to the car, or listings of similar vehicles in your area with higher selling prices. If your car had a low mileage or was in exceptional condition, gather any available documentation to prove this.

- Challenge the Valuation: Once you have gathered your evidence, challenge the insurer's valuation. Write a detailed letter or email explaining why you believe their valuation is too low and include all your supporting evidence. It's best to use a method that provides proof of receipt.

- Use the Complaints Process: If your insurer doesn't adjust their valuation satisfactorily, you can escalate the issue through the company's internal complaints process. They're obligated to give you information about how to do this.

- Involve an Ombudsman: If the dispute remains unresolved after going through the insurer's complaints process, you can involve an ombudsman service. In the UK, this would be the Financial Ombudsman Service. The ombudsman will review your case independently and their decision is usually binding on the insurance company.

If you process your non fault claim through an accident management company, like Auto Claims Assist, we provide accurate and fair pre-market value for your vehicle in the case of a write-off. When claiming with Auto Claims Assist, and in a situation where the insurer's valuation is lower than the actual market value, we assist in the dispute process, guiding you through gathering evidence and negotiating with the insurer.

If you want to speak to a member of the team about a car written off not your fault or a write-off valuation, call us today on 0330 128 1407.

Start my claim with Auto Claims Assist.

Get your claim started by requesting a callback with our new claim team.

Fill in the below form and one of our advisors will call you back as soon as possible. Alternativly, call us on 0330 128 1407 to speak to us during working hours.